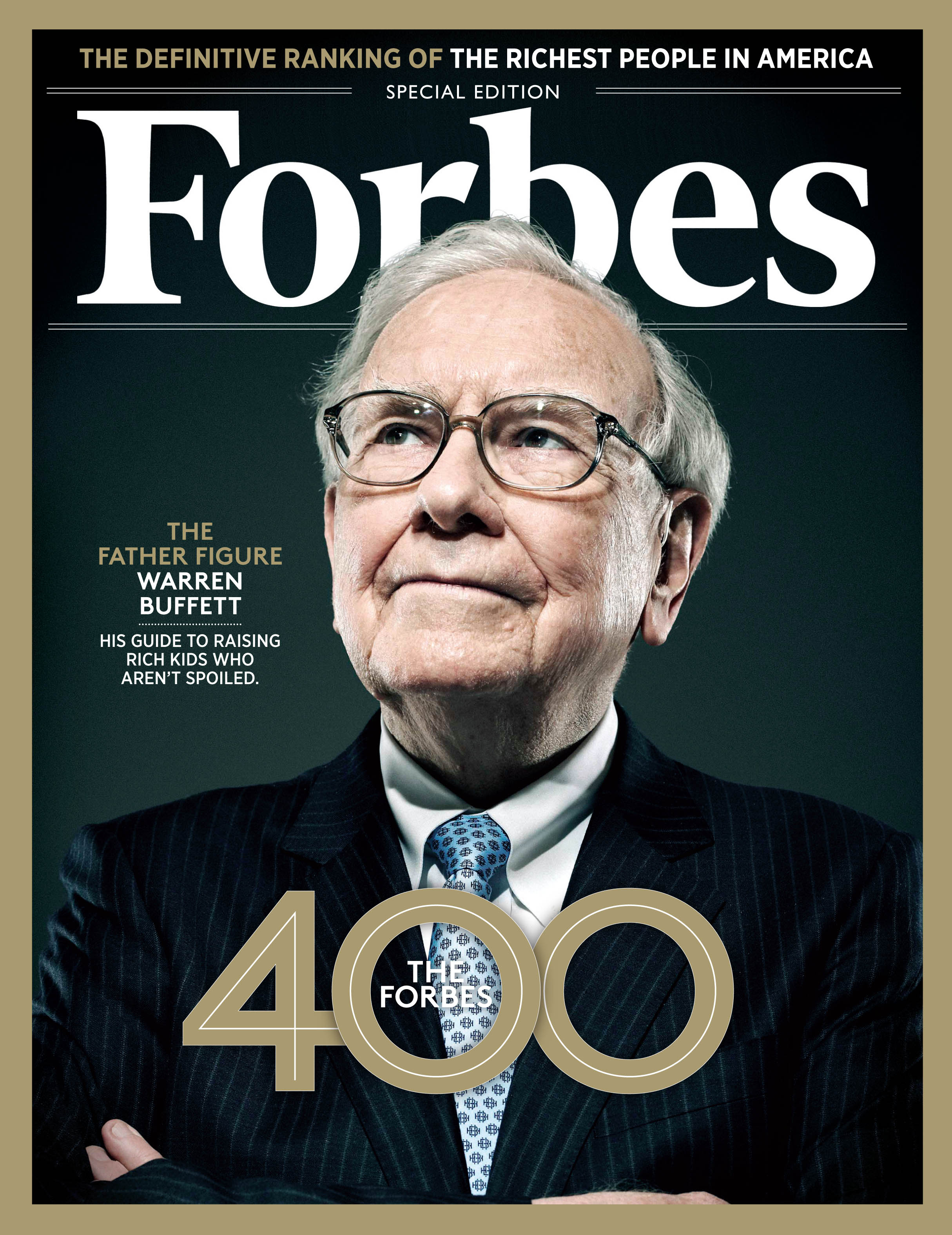

Legendary investor and Berkshire Hathaway CEO Warren Buffet dropped his annual shareholder letter last week, and as usual it is full of insights about investing and business and offers plenty for anyone interested in better performance - of investments, organizations, or individuals to think about and learn from.

1. On taking the long view

Buffett: "Games are won by players who focus on the playing field -- not by those whose eyes are glued to the scoreboard. If you can enjoy Saturdays and Sundays without looking at stock prices, give it a try on weekdays."

HR/Talent lesson: Like many investments, the true payoff on many talent decisions/initiatives are only realized in the fullness of time. New hires can take as long as a year to be fully productive, that big HRMS project could have an 18-month timeline, and that new recruiting blog or Facebook page you've set up is simply not going to catch in the first month. We want, or are trained to expect, a faster payoff or return on everything we do, but as Buffett reminds us, often patience will be rewarded. Probably the most difficult, and most valuable, ability for any manager is the ability to know just how long to keep pursuing a strategy and when to change course.

2. On understanding your strengths and weaknesses

Buffett: "You don't need to be an expert in order to achieve satisfactory investment returns. But if you aren't, you must recognize your limitations and follow a course certain to work reasonably well. Keep things simple and don't swing for the fences."

HR/Talent lesson: This is the classic workplace trap of wanting to do everything yourself, followed closely by trying to staff your team with people that also think they can do everything. I am utterly convinced people are more happy, engaged, and productive simply doing the things they are good at more often than they have to attempt the things where they are not so capable. Let people build on their strengths, don't focus obsessivley on trying to push them into areas where they are not ready, or not as talented. Some folks will want to stretch and challenge themselves no doubt, but not everyone is that comfortable or that driven, and that is ok too.

3. On listening too intently to what others think

Buffett: "Forming macro opinions or listening to the macro or market predictions of others is a waste of time. Indeed, it is dangerous because it may blur your vision of the facts that are truly important. (When I hear TV commentators glibly opine on what the market will do next, I am reminded of Mickey Mantle's scathing comment: "You don't know how easy this game is until you get into that broadcasting booth.")

HR/Talent lesson: I am a pessimist or a cynic I suppose, but I remain convinced that about 75% of the people you know really don't care about your career success, 20% are actively conspiring against you to various degrees, and maybe 5% are truly in your corner. You should care about what these 5% have to say, listen to their advice, etc., and everyone else should be ignored. Completely. And if you are not sure if a particular person is really on your side or not, then you can just assume they are part of the 95% you should be ignoring and thus, ignore them as well.

Once again, really solid advice and perspective from a guy who's credentials mostly speak for themselves. Think about the medium term and long term, know what you are good at (and like to do), and don't get caught up in what the crowd thinks - most of them hate you and want you to fail anyway.

Have a great week!