Lots of noise and stress lately that comes from a political transition and in this case a transition to a philosophy that is a dramatic departure from at least the last eight years, (if not longer). I did my one and only (I promise) take on the most controversial happenings (so far), on Monday, but I wanted to hit one more quasi-political issue, but also one that impacts work, business, and potentially jobs.

Namely, the staggering amounts of cash that many of the largest American firms are holding, and in particular, the increasing levels that these firms have 'parked' in overseas accounts (ostensibly to avoid paying US corporation income tax on the funds).

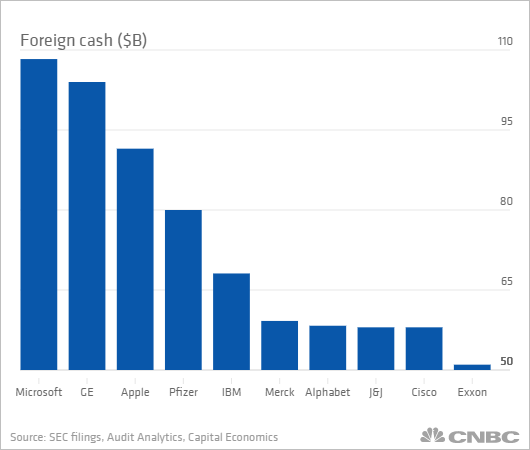

Here's a reasonably recent chart (from last September) showing some of the larger companies and overseas cash piles, (courtesy of CNBC), then some comments for me after the data.

Three quick takes on this stockpile of overseas cash (and large cash reserves by corporations in general)

1. American companies are holding about $2.5 Trillion (that is with a 'T') in overseas cash, which is more that 10% of the US annual GDP. Tack on the close to $2.0 Trillion, (that is another 'T'), in cash that US companies are holding domestically, you have about $4.5T in cash that is essentially doing nothing to build business, increase investment, hire more people, etc. Lots and lots of arguments for why this is the case, (not all of them political in nature), but I think we all can agree that this tremendous cash hoard represents untapped potential for growth.

2. The main reason that American companies cite for parking so much cash overseas is the relatively high US corporate tax rate of 35%. It is by most analyses the highest corporate rate among developed economies. So when you combine a high tax rate, an additional surplus of domestic cash for many large companies, and still low by historical standards borrowing costs, many of the largest US companies are content to sit and wait and stare at their cash piles.

3. Finally, many economists predict that a lowering of tax rates and a surge in repatriation of corporations overseas cash probably would not spur the kind of economic stimulus that many expect. Many of these firms would use substantial portions of this cash on stock buyback programs and increases in their dividend rate. These actions primarily benefit shareholders rather than the broader economy. Besides, some argue, if these companies had better ideas to invest this cash (new facilities, R&D, hiring more people, etc.), they would just do that.

Sure, I know that most organizations, particularly smaller ones, would love to have the problem of not being able to figure out what to do with all their excess cash laying around. But all this cash is certainly not a great sign for longer term economic growth, increased innovation, and enhanced employment opportunities.

It is going to be interesting, if a little wonky, to keep an eye on corporate tax rates, repatriation deals, and just what ends up happening to these Trillions in the next few years. I suspect that whatever happens, it will have a pretty significant impact on US GDP, growth, employment, and more.

Happy February.