UPDATE: Who benefits from corporate tax rate cuts?

About a month ago I had a piece on the blog about the recent cuts in the corporate tax rate for US companies - more specifically, I looked at what companies were actually doing, (or have stated they will do) with the proceeds of these cuts, and how organizations may or may not be able to leverage these plans in their recruiting and retention efforts.

Long story short, last month I said, (and shared some data) that said most companies are taking care of shareholders before and to a much more substantial degree than they are looking after current employees (with raises, bonuses, increased development opportunities), and potential future employees, (investing in new facilities, R&D expansion).

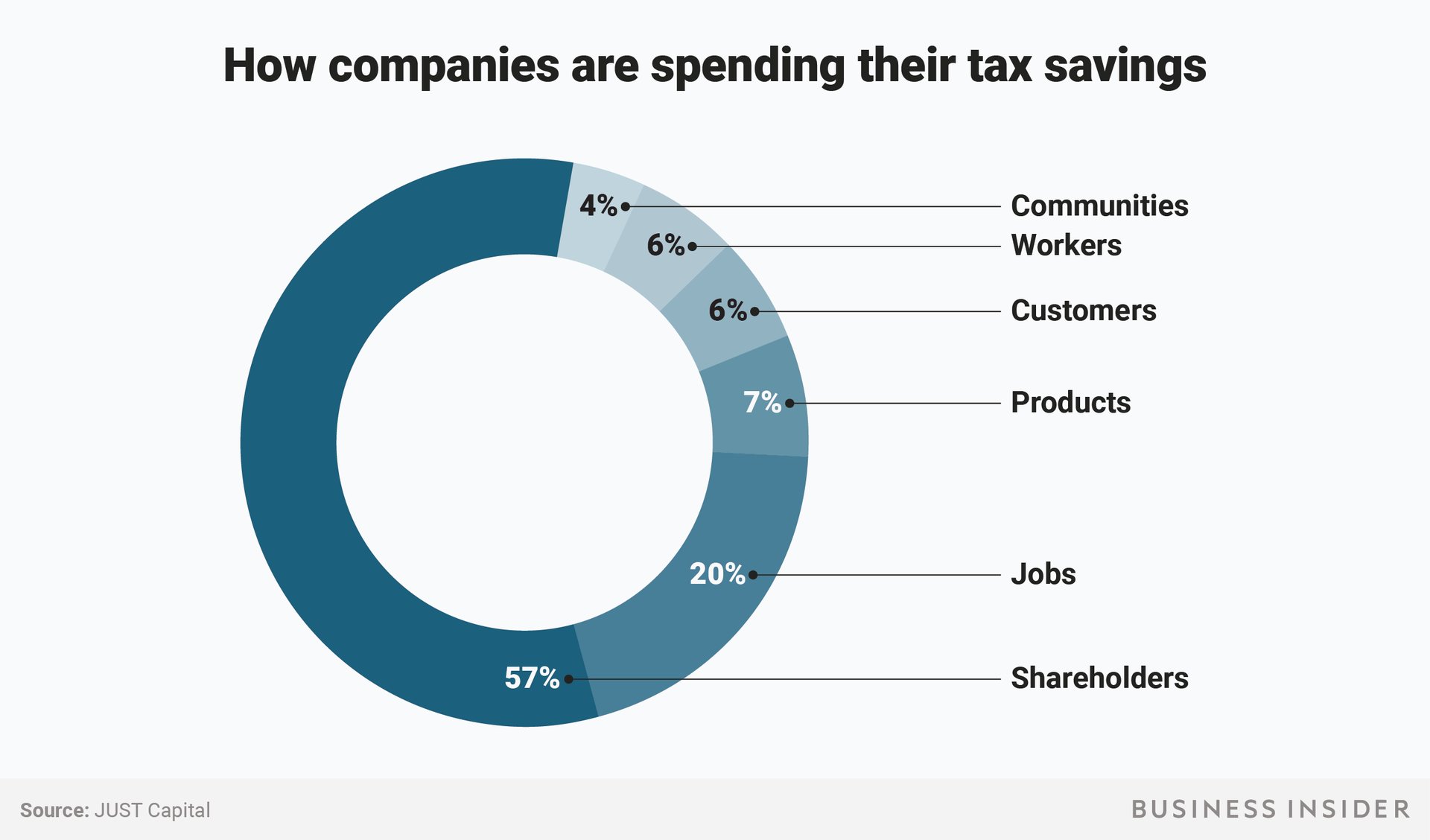

Well, some more and more current data about corporate spending plans for their tax cut driven windfall is in, and sadly for (most) workers, the story has not changed all that much. Courtesy of Just Capital, a non-profit organization that has been monitoring what large US companies are doing and planning to do with these proceeds, have a look at how about 120 large organizations are allocating these new found funds:

If you can't see the chart, (email and RSS subscribers may need to click through), the data breaks down by category of corporate stakehiolder or potential spending group as follows:

Shareholders - 57% (stock buybacks, dividends)

Jobs - 20% (commitment to job creation, capital investment intended to add jobs)

Products - 7% (invesment in product quality or benefits)

Customers - 6% (reduced pricing, increased service, privacy, safety)

Workers - 6% (wages, bonuses, benefits, training)

Communities - 4% (charitable giving, matching gifts, volunteering)

Although the many announcements and rounds of one-time bonuses that many corporations have granted to employees have generated a lot of news, the Just Capital data continues to show that these programs and plans amount to an exceedingly small percentage of the total corporate benefit of tax cuts - estimated to be about $150B in 2018 alone.

As I speculated the last time I looked at this data, organizations that were really making a meaningful and greater than average commitment and investment of these tax windfalls in their employees would likely be able to leverage the investments effectively as a tool for retention and increased overall employee loyalty. And potential new recruits could also be attracted and drawn to organizations that if not putting their employees first on the stakeholder pecking order, at least consider them to be more important (relative to shareholders for example) than competitors and industry averages.

And here's one more bit of interesting information to consider for organizations and leaders trying to decide the 'best' allocation of tax savings. Just Capital periodically polls American's attitudes towards corporations - mainly to find out which corporate behaviors are seen as being the most 'just' or fair. In the most recent polling, how corporations treat their workers came in as the most important category in evaluating these corporations, with almost a quarter of respondents ranking worker treatment as number one.

Shareholders? How corporations treat them came in last, with only 6.4% of respondents naming their treatment as most important when assessing corporate behavior.

Lots to chew on here for sure. I will probably let this topic go for a while, as frankly its a little depressing. I suppose for most organizations, it is better to be a shareholder than anything else.

Have a great day!

Steve

Steve