CHART OF THE DAY: ETFs, Active Managers, and Human Specialization

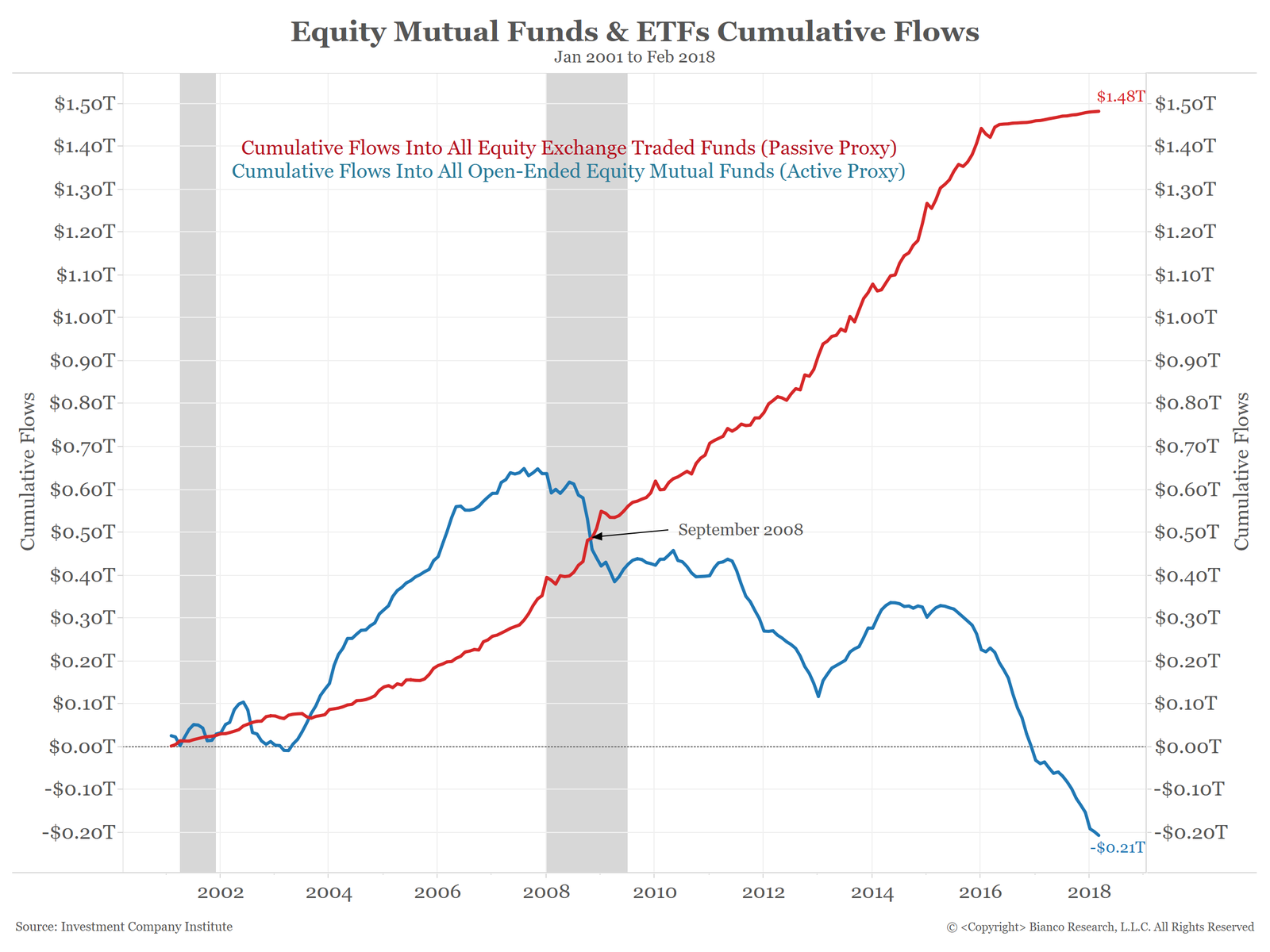

Today's Chart of the Day comes to us from the world of Finance and our pals at Bloomberg and shows just how once type of job, the "active", (and human) mutual fund manager is being disrupted by another kind of manager - a 'passive' one, modeled against the market more broadly, and dominated by algorithms and sophisticated computers.

Long story short - investors have been migrating their money away from the active, people-driven funds and strategies and towards the passive, ETF-type funds. Here's the chart from Bloomberg, then some comments below from your favorite active blog manager (me).

Some really interesting things to note from this chart. And recall, just like when we blog about basketball here, this blog about finance and investing isn't really just about finance and investing.

1. Highlighted on the chart is the worst of the financial crisis, September 2008. This appears to be the inflection point where investors bailed on active investment management in favor of passive investing. In other words, when times were tough, investors didn't seek 'expert' human management for their diminishing funds. In fact, they sought out the opposite.

2. As the chart above demonstrates, the current active management model for investments simply can't compete any longer with the cheaper passive/ETF model in either total asset gathering (trying to simply grow the way to prosperity), or in terms of returns. Whatever the current strategy is for the active managers, it is definitely not working and has not been for a decade.

3. So what can these highly-paid, expensive, and under threat active fund managers do to at least try and maintain some relevance and hold on to their country club memberships and beach houses? Bloomberg suggests one approach - hyper specialization.

From the piece:

What does the future of active management look like? We believe it should only seek a portion of an investor's assets. To do this, they will have to create highly idiosyncratic and concentrated portfolios. They will have to find the one thing they do well and do it in a concentrated, risk-seeking way, whether it be health-care, emerging markets, macro themes, algorithms, technology or trading. The manager will need to be known as the "go to" person in that space to emerge as the next star, allocating capital as efficiently as possible.

Again, the specific example/industry/job role doesn't matter here. What matters is the method and approach for people to remain valuable and competitive in a situation where machines and algorithms have plenty of advantages. The advice is not to try and out-compete the robots where you simply can't defeat them, but rather to seek out those areas, pockets, and opportunities where you can leverage uniquely human skills and experience to stay one step ahead of the machines.

Super interesing article and one that I think no matter what industry or job you are in, has something we can learn from as well.

Have a great day!

Steve

Steve