CHART OF THE DAY: How tough is it for US corporations right now?

My short answer to this question on a week where most US corporations are seemingly headed to catch a big tax cut courtesy of a 'last gasp at getting something done in 2017' federal government - not really tough at all.

Here are three quick charts that certainly don't claim to exclaim everything about the current state of health of corporate America, but are a good starting place. Take a look at the data, soak in some FREE for the holidays commentary from me, and draw your own conclusions. Or even better, use these to launch your own digging.

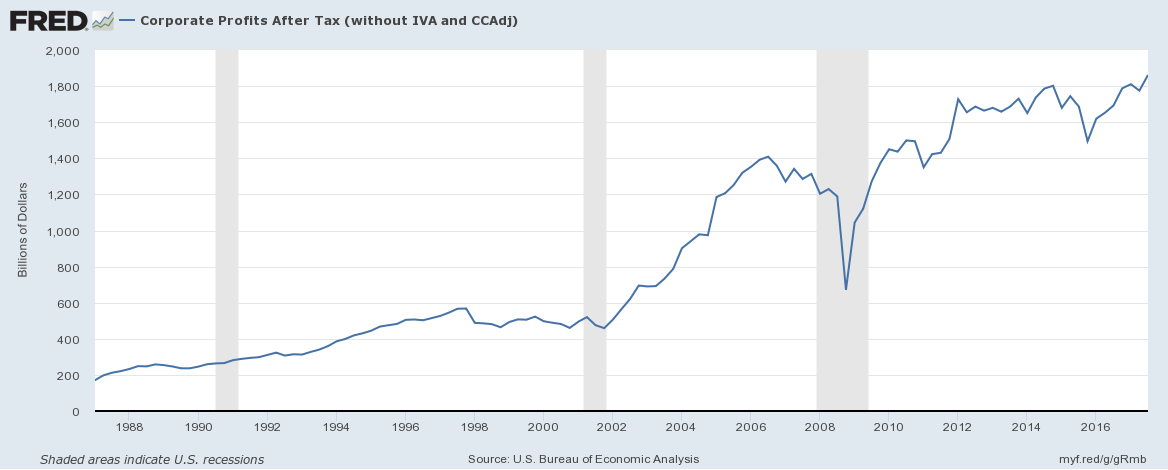

First - US corporate profits in total dollar terms. Without looking at the chart, I bet you can guess where the line is trending. (Data courtesy of the awesome St. Louis Fed FRED site.)

This is a thirty-year look at corporate profits in total dollars. After cratering at the end of the financial crisis in 2009, a steady and continuing rise as corporations, employment, and the economy overall have rebounded.

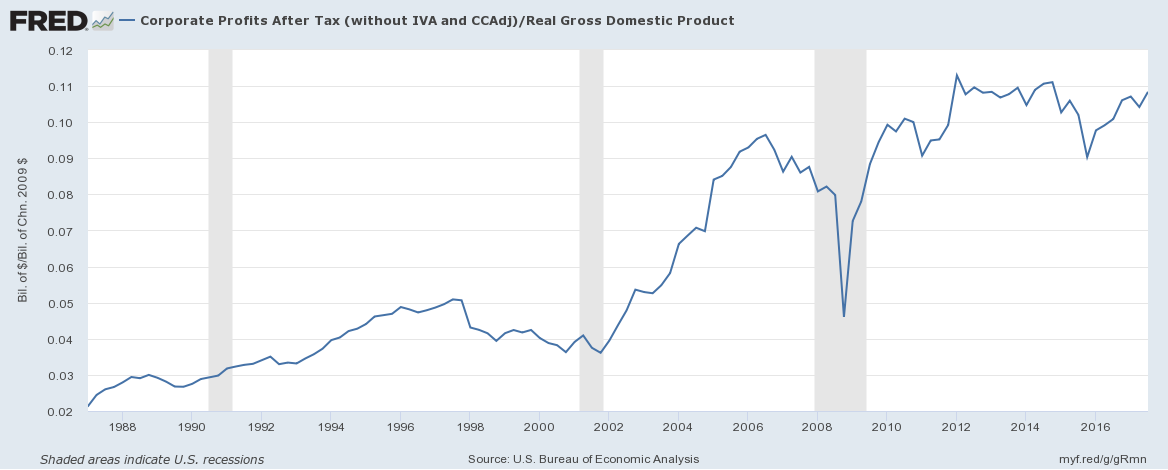

But, what about profits in terms of the overall economy? Are corporate profits taking a smaller or larger percent of GDP? Or are profits in line with historical trends?

Next chart, the same corporate profits data in Chart 1, this time expressed as a percentage of overall US GDP.

From this chart we see that not only are corporate profits increasing in total dollar terms, their percentage of overall GDP has also increased pretty steadily as well. The last few years this value has fluctuated between 9% and 11% since the end of the financial crisis. I reduced the chart size down some for clarity, but if you look back at a longer view of historical data, back say to the fifties and sixties, corporate profit as a percent of GDP never was more than about 2%. Said differently, not only are corporate profits the highest they have ever been, their share of GDP is also at or near historic highs.

One more chart then I have to get back to pre-holiday prep. You probably have heard some news about new record highs in the US equity markets, a reflection on the value, performance, sentiment and overall health of publicly traded corporations as well as the US (and global) economies in total.

But just to make the point visually, here is what the S&P 500 index, a broad-based index that is a good proxy for the total equity market, looks like over the last 60 years or so.

The market has run up so much in the last 20 years or so that 1950 - 1985 barely even register on the chart, appearing to be close to 0. You can definitely argue that equity values are not always a perfect measure or reflection on the health of corporations, and in any economy, (even a growing, healthy one like we have now in the US), there are going to be winners and losers, but the run-up in markets over the last few years has to mean something.

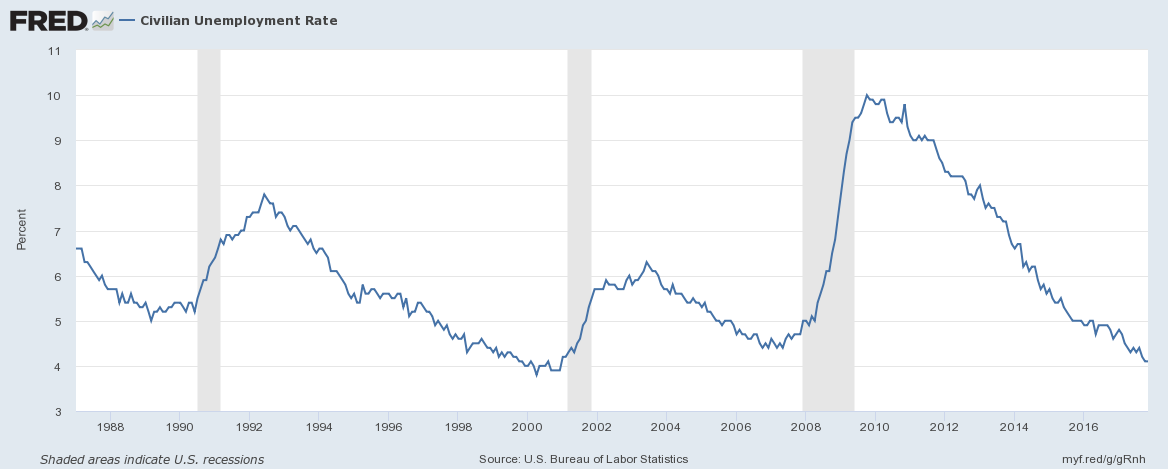

At the top I said I wanted to share three charts of information on corporate health. I want to toss in one more, that is more an indicator of overall economic health. Take a look at the overall US unemployment rate over the last 30 or so years.

We are at about 4% 'official' unemployment in the US - a figure that is close to what economists like to call 'full' employment. You could argue that in the modern world with (theoretically) more efficient matching between job seekers and job openings that 'full' unemployment can hit more like 3%.

Again, I trimmed the chart for clarity, but you have to go back to the early 1950s to see a sustained period of lower unemployment in the US, where rates bottomed out at about 2.5% in the years just after WWII.

Add all this data up. Think about how your organization and the ones in your industry are doing. Check your 401(k) statements at the end of the year.

And then ask, is this the right time to push for a big corporate tax cut? Are corporations really 'hurting?'

I don't know, but I think they are good questions to ask.

Have a great day!

Steve

Steve

Reader Comments (2)

Get your favorite pret shirts on sale in Pakistan from Etisal. You can shop for any type of pret shirts in different styles and colors. We have the latest collection of pret shirts for women. It's a good opportunity to buy women's pret shirts on sale online in Pakistan.

The writing style is la fontana della citta engaging and easy to follow.