ECON 101: What do falling oil prices mean for you?

I am a big mark for finance, economics, business news, etc. And one of the most interesting business/markets stories in the last few months has been the pretty dramatic decrease in the price of crude oil, and probably more importantly to you, me, and our workforces, the corresponding fall in consumer prices for gasoline.

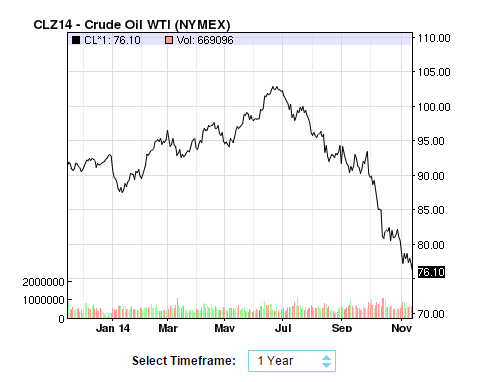

Check out the two charts below for some context: first, what has been happening with Crude:

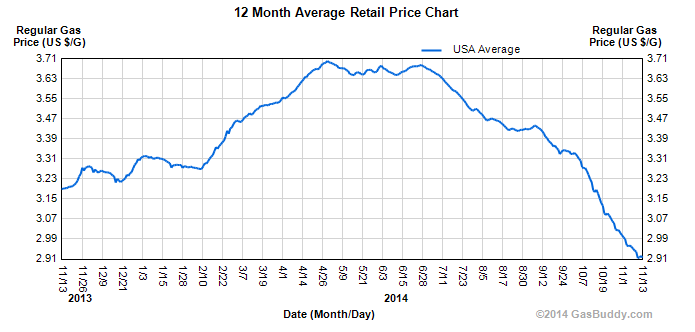

How about the average price of gas? Here you go:

Pretty clear from these two charts what has been happening - crude oil has been on a pretty steep fall, dragging down the average price of gasoline along with it.

What might that mean for the savvy HR/Talent professional? Three quick hits, then I'd love your thoughts.

1. Compensation - the fall in gas prices is sometimes referred to as a 'free tax cut' for consumers. But if we spin that just a little, you can frame the drop in gas prices as 'off-cycle comp increase' for employees. Seriously, you can't actually say that out loud, but the truth is many of your employees have a few more dollars in their pockets each month. Maybe you (or a line manager) can feel a little more emboldened about calling back to the office some of your slacker telecommuters?

2. Operations - If you are in the business of moving any kinds of goods around the country/world, then you are seeing a pretty steep decline in transpiration costs. In the same way that a fall in gas prices puts an unexpected few extra $$ in each individual's kitty, the decline in costs for truck, rail, and eventually even air shipment costs will be a benefit to many organizations. Keep an eye on that line of your shop's P&L, (you do review the P&L each month, right?), and see if you can't time your request for a new HR system/program/technology along with a bump in margin.

3. Oil and Gas industry - Opinions seemed mixed on the overall impact to the US oil and gas industry, which has seen a remarkable renaissance of sorts in the last decade. At some point the price of Crude could fall to a point that jeopardizes domestic production. We are probably not (yet) at that point however. But there certainly could be a slowdown in the rate of growth in capacity and then the jobs that are being created in the US oil and gas sectors.

It is pretty cool to pull up to the pump and see prices on a continual decline. Heck, you may even now be able to fill up the tank in your monster SUV for less than three bills.

But what is cooler still is to have an idea, an understanding, and an appreciation about what this kind of macro-economic trend means for your business and your employees.

What do you think, have falling oil/gas prices made any impact in your HR shop?

Steve

Steve

Reader Comments (1)

Steve, I am enjoying your blog. I like it that you are tracking on business issues that impact HR professionals like robots, oil prices, etc.

The broader context of the drop in oil prices is probably more important than the drop itself.

If the drop is primarily caused by the drop in demand associated with a lower global GDP output then the associated global recession/depression is what HR professionals should be focused on. Strategic tasks could include staff reduction planning, succession planning, identification of must retain employees, and a plan B compensation model that retains and rewards the critical remnant required for business continuity through tumultuous times.

If the broader context of the drop in oil prices is primarily a result of rising oil production via new sources and geopolitical shifts like saudia arabia and russia adjusting their output, then for most of us it will be business as usual but the energy sector may have to scale back new projects until the price creeps back up which will impact hiring and layoffs in that industry. I think it will remain business as usual for the rest of us because the rise in food prices more than offsets any net benefit to the employees from dropping oil prices as stealth inflation continues to erode actual purchasing power of most employees.

http://www.usatoday.com/story/money/business/2014/03/18/food-prices-rising/6557417/

Keep up the good work in providing keen insights and asking hard questions!