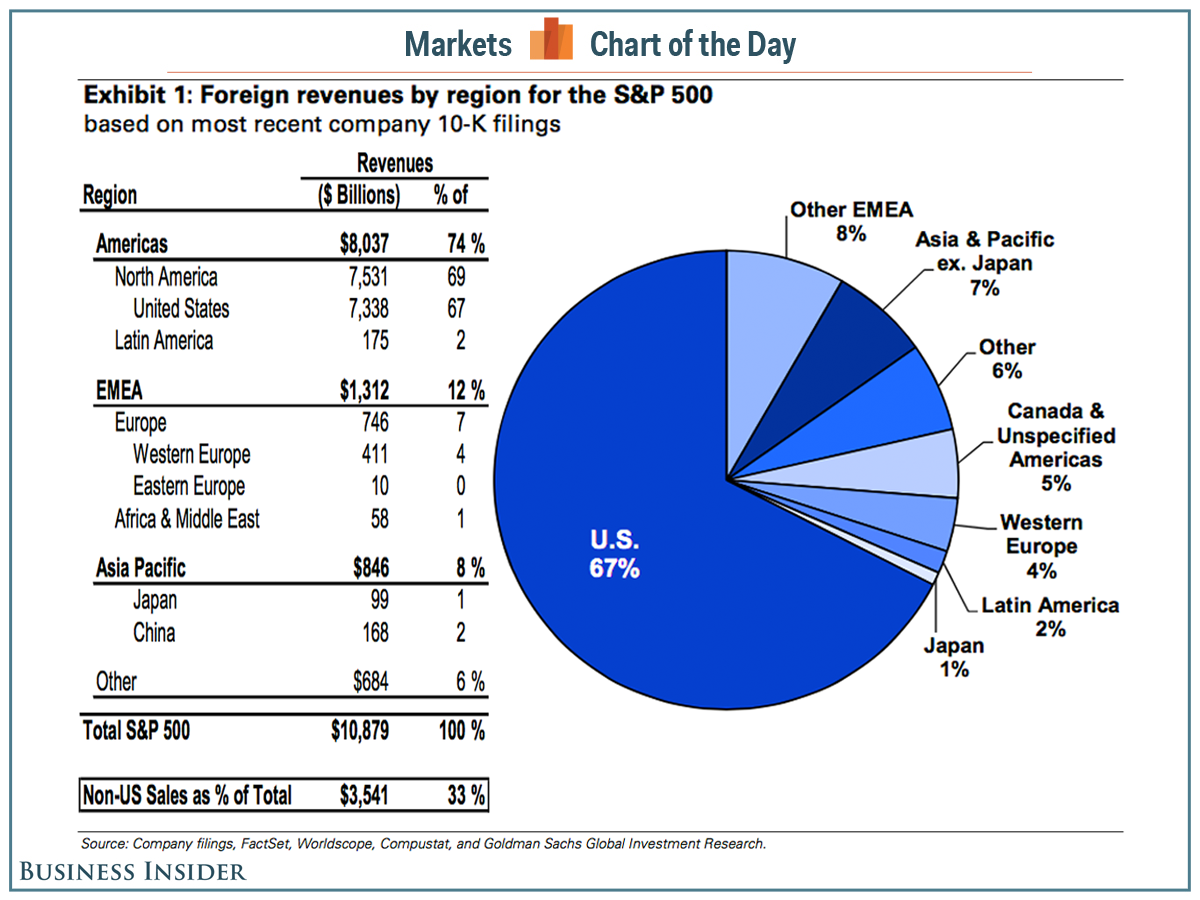

CHART OF THE DAY: Reminding you that China is really, really big

Regular readers of the blog will remember that I've been fortunate enough to be a part of the first two HR Technology - China Conferences in 2016 and earlier this year. Both times visiting China, learning more about the HR and the HR technology ecosystems there, and meeting some truly engaged HR leaders, I have left more and more impressed and in a way, awed by the size, scale, growth, and innovation of HR and HR tech in that country.

I look forward to going back in 2018 for sure and in the meantime, I am a member, (the only non-Chinese member I think), of a 30-person strong group chat on WeChat titled 'AI in HR', where HR folks I met in China share information and discuss innovation in HR and HR tech. It is really cook, even if I can only successfully translate about half of it. Get on that, WeChat.

So I'm a mark for interesting information and additional insight about China and when I saw the below chart/infographic, wanted to share on the blog as a reminder for those of us that sometimes forget, or just never think about, the scale and size (and opportunity), the growth opportunities for businesses of all kinds that China presents.

So here's the chart, courtesy of Visual Capitalist, then a comment or two from me after the data. Email and RSS subscribers may need to click through to see the chart.

Pretty amazing, right? That many 'mega-cities' that rival many medium to large countries in terms of the size of their economies.

A couple of things struck me. One was kind of personal in that the first HR Tech China Conference was held in city called Zhuhai, which, (it seemed to us), was a really large, growing, busy, and important city in Southern China, strategically positioned between Kong Kong and Macau. That city, Zhuhai, does not even crack the Top 30 in terms of economy size in China. Amazing.

And last, taking a closer look at the map in China, and thinking about these different cities and regions and how they are different, i.e. some still focusing on manufacturing while others are financial centers or hubs for innovative new tech (like AI), reminds me that it is really, really hard to get to 'know' China from just taking a few business trips or attending an event or two. Spending four days in Beijing and thinking you 'get' China would be like taking a long weekend in New York City and concluding that you 'get' America.

Anyway, file today's post under my philosophy for the blog since 2008 - 'It's interesting to me, so I'm blogging about it'. Your mileage may vary.

Happy Tuesday.

Steve

Steve