CHART OF THE DAY: Competition is global - at least one-third of it is

Today's installment of the Chart of the Day series I think represents perfectly why I like to run these posts - it actually uses hard data to reveal the reality about a topic about which it can be really easy to sort of just accept without much research or questioning.

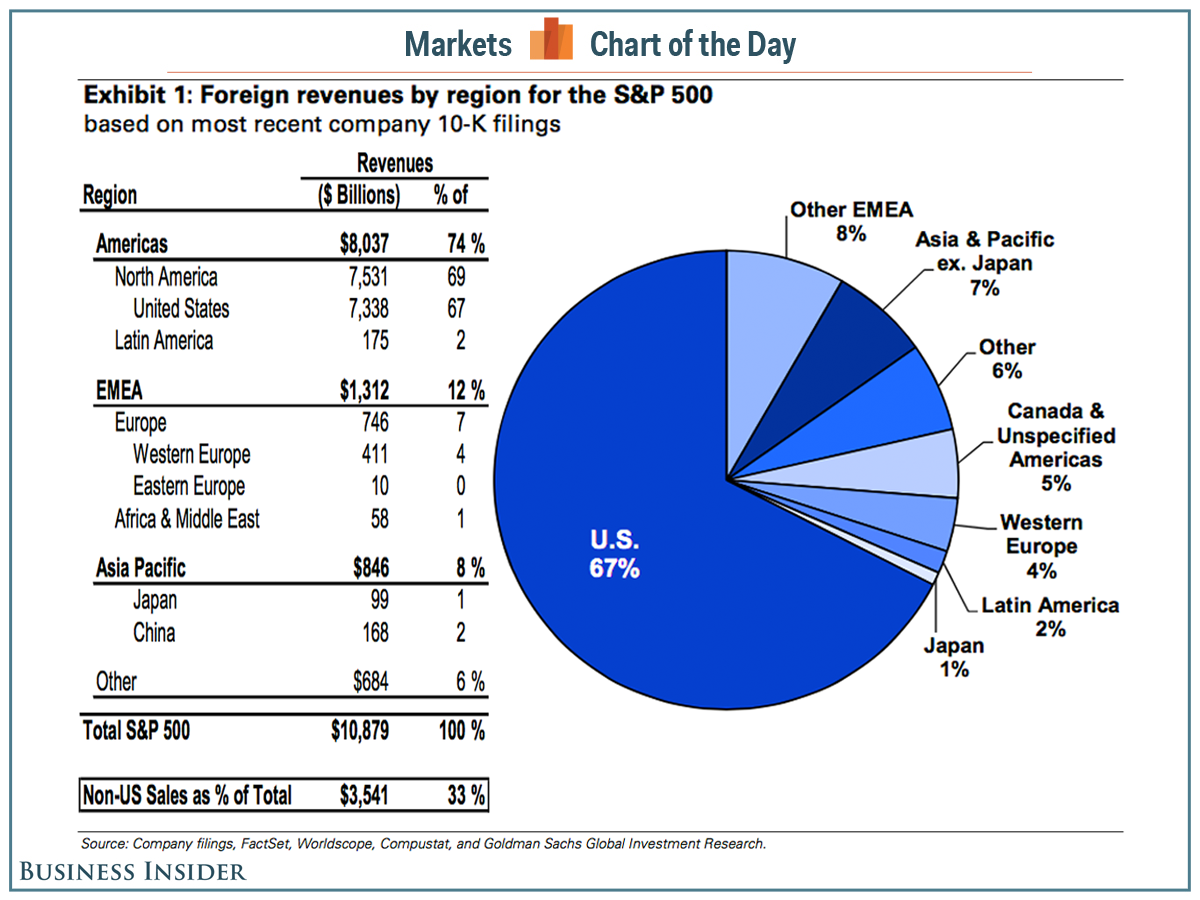

Quick - before looking at the data, try to take a stab at answering this question: In the modern, connected, networked, and global economy, about what percentage of revenues of large US-based companies (represented for the sake of argument by the members of the S&P 500), are earned from outside the USA?

About half? Maybe more? I'm not sure, but I bet it is a lot?

Let's look at the data, then a couple of quick, FREE observations from your pal. That is me.

Some quick takes:

1. It may be a little hard to read, so I will break out the important numbers. Total revenues earned outside the US by the members of the S&P 500 companies is about 33%, with the largest share of non-US revenues coming from EMEA, (12%), and APAC, (8%). I am not sure about you, but when I saw this data, I was really, really surprised still in 2015 how much domestic revenues dominate the mix in America's largest companies. I mean I feel like we have been hearing FOREVER how all competition is now global, and that in order to grow most companies have to look outside the USA. So while I do think that is still true, I was surprised by the extent to which neither of those things are really happening in a significant way.

2. Having said that, your organization's best opportunities for growth may still be in the USA. If nothing else, these statistics reveal still how hard it is for US-based companies to compete in foreign markets. At least 25 years of attention to places like Asia and Europe still have not generated much more than about 10% of the S&P 500 companies revenues, respectively. If you are a smaller company, perhaps you should still keep your primary and secondary growth strategies focused on the domestic market, even if you feel like it is a tapped out. Upselling, expanding your target customer size, making adjacent market moves are all much, much easier on familiar territory than they are in one of the hundreds of places in the world who have no idea who you are.

3. It is more important to have diversified customers, no matter where they are, than customers all over the world. Reducing your organization's reliance on one market, even one the size of the USA, sounds like a smart strategy. But if the reality of the difficulty in cracking markets overseas makes the 'global' strategy too hard to execute, then domestic diversification is the next best, (maybe even the best) thing. It is more important to make sure that one or two massive customers don't represent half of your revenues than it is to worry that 96% of your total revenues come from inside the USA.

So that's my take, I found this data really interesting and surprising too. Would love to hear if you felt the same.

Have a great Tuesday!

Steve

Steve