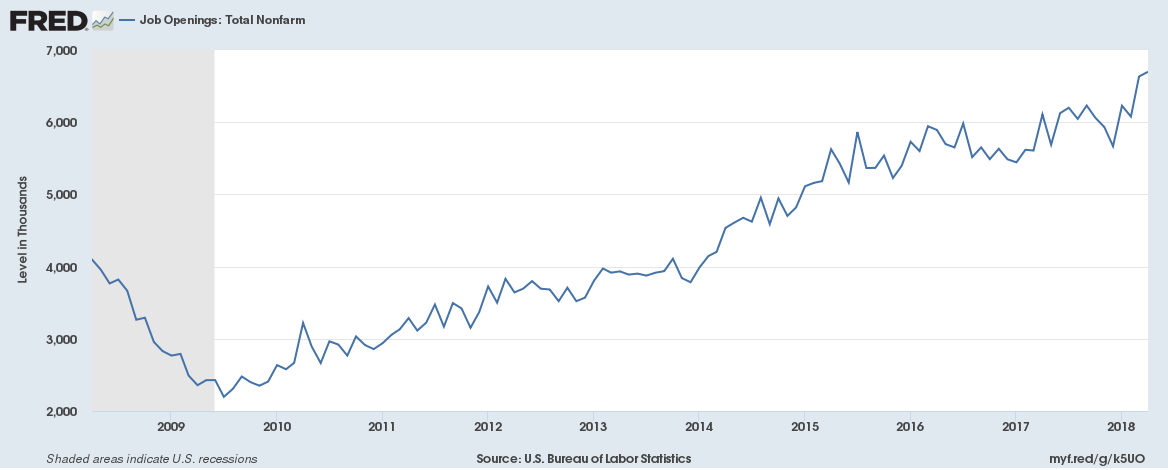

CHART OF THE DAY: Another all-time record number of open jobs in the US

The most essential state of the labor market report, the JOLTS report, was issued a few days ago by our pals over at the Bureau of Labor Statistics. I won't bury the lead, the chart below shows most all of what you need to know from the Dec 2018 JOLTS data - namely, there were over 7.3 million open jobs in the US, an all-time high, at the end of December 2018.

For those keeping score at home, the number of open jobs cratered in July 2009 at about 2.2 million and for just about a decade has steadily climbed to the 7.3 million number the BLS has just reported.

And one more data point from the JOLTS, for the last nine months or so, there have been more open jobs in the US than officially unemployed persons to fill them. Said differently, even if we could magically place every current unemployed person in one of the open jobs, there would still be hundreds of thousands of jobs unfilled.

There is good (lots of open jobs means lots of opportunity and optimistic companies looking to grow), and bad (why can't we get better at hiring, training, and expanding opportunity) in this kind of number. All things being equal, the state of the labor market in Dec 2018 is much, much more preferable to the nightmare of July 2009. But here's the funny thing - it might seem like a lifetime ago, but it really wasn't.

That's it from me - have a great weekend!

Steve

Steve