CHART OF THE DAY: What age group has employment rising faster than population?

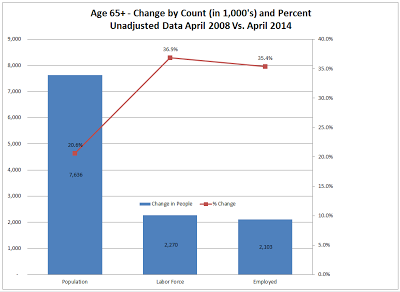

Quick hit for a busy Tuesday - I wanted to share a chart (and the link to a few more interesting charts), on population growth, labor force growth, and employment growth between 2008 and 2014 for one specific category of workers - those aged 65 and up.

First, here is the chart from Mish's Global Economic Trend Analysis, then some observations and free commentary:

Apologies if the chart resolution isn't great, but hopefully you can still make out the key pieces of data. Essentially, while the population growth of those aged 65+ is really high (about 20% of an increase in this group since 2008), the rates of increase in labor force participation and employment are even higher (about 37% and 35% respectively).

Additionally, this is the only age group where the labor force and overall employment rates are outpacing population growth. For example, 16-24 year olds have seen their ranks increase by about 4%, but employment for that group has declined about 6%.

I know I have posted a few times about the general increase in age of the workforce, and the challenges and opportunities this presents to organizations, but it is probably worth thinking about perhaps more frequently than before. Older workers are often overlooked, and can present great sources of experience, insight, and even value, as any folks in this cohort do probably realize that they might be outside of their prime earning years. Also, many will be motivated by the opportunity to share their knowledge and give back as it were to their less experienced workers - which is exactly the kind of on the job learning and mentoring that the next generation desires. Lastly, you probably don't have to be that concerned, (if at all), with ongoing development and career pathing with this group - they have likely ran most of their career journeys already.

Anyway, this will have to be the last time I go on again about the aging workforce, I think the point has been beaten into submission. Unless I am still blogging say 20 years from now, where I will be screaming about the value of the older workers as far as I can still shout.

Happy Tuesday.

Steve

Steve