One type of consumer debt is at a record high, and it could impact your Employee Benefits strategy

Quick shot for a busy, 'Did I just read the wrong Best Picture winner?' Monday.

From our pals at Bloomberg, reporting on the recently released Quarterly Report on Household Debt and Credit out of the Federal Reserve of New York.

Total U.S. student debt hit a record $1.31 trillion last year, the 18th consecutive year Americans' education debt rose, according to the Federal Reserve Bank of New York.

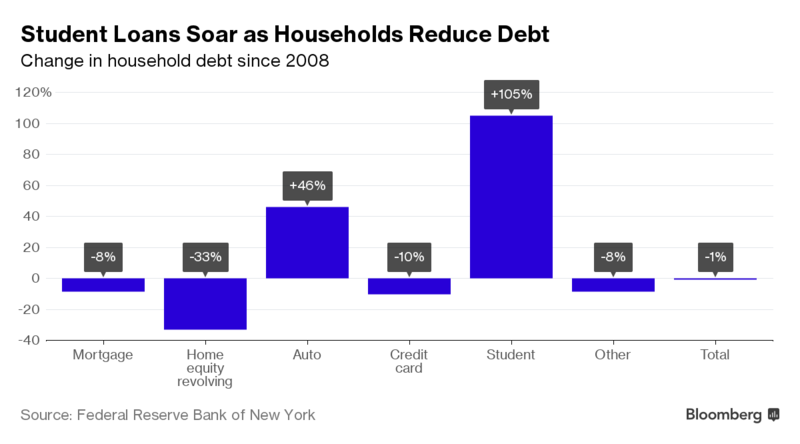

Outstanding loans taken out for higher education have doubled since 2009, data show. No other form of household debt has increased by as much since then. In fact, of the six major categories of consumer debt tracked by the New York Fed, only student loans and auto debt have increased since year-end 2008 (total auto loans are up 46 percent). Total household debt has fallen by 1 percent

There are some more interesting nuggets on what is happening with student debt in the New York Fed report, including the fact that among the five major types of household debt (mortgage, home equity, student, auto, and credit card), student loan debt has the highest percentage (11.2%) classified as 'seriously delinquent', i.e. over 90 days late.

Finally, this chart from the Bloomberg piece illustrates how much faster student debt has risen compared to the other forms of household debt since 2008:

Add all of this up and it points to an environment where student loan debt loads are increasing, former students are having a tougher time keeping current on repayments, and many if not most of your newest employees are walking into their brand new jobs in a state of financial difficulty.

A number of organizations have responded to these circumstances by offering student loan repayment assistance or contributions as a part of their benefits offerings. According to Time.com, Chegg, Penguin Random House, and Aetna are among the companies that have implemented schemes that contribute to employee's student loan repayments. And a number of technology/services offerings from providers like Gradifi, Student Loan Genius, Tuition.io, and SoFi are marketing these programs and schemes to employers.

It seems pretty likely that the student loan debt crisis is not going away any time soon, (has any college or university ever cut tuition prices?), and that candidates increasingly burdened by debt will begin to actively seek employment opportunities that both recognize and can offer assistance to them in this area.

Sure, offering student loan payment assistance as a new benefit will come off as just a 'cost', at least in the sort term. But looking at it from a wider angle, it could be an important differentiator in candidate attraction and employee retention.

And it could be that along with the other early adopter companies mentioned above, you can finally get in front of a trend for once, instead of having to chase it three years from now.

Happy Monday - have a great week!

Steve

Steve