Labor Markets: Moving Parts and Search Friction

One of the best and most consistent sources of information and analysis of big picture data about the US Labor Market is the Federal Reserve Bank of St. Louis. The regional reserve bank was established in 1914, after the creation of the Federal Reserve System in 1913. The Eighth Federal Reserve District is headquartered in St. Louis and has branches in Little Rock, Arkansas; Louisville, Kentucky; and Memphis, Tennessee. Aside : Those cities sound like the stops on an epic barbecue tasting tour.

Recently the bank issued an updated version of its 2011 report titled Many Moving Parts: The Latest Look Inside the U.S. Labor Market, an examination of the dynamics of the labor market, the problems with “one size fits all” type recommendations to 'fix' the unemployment problem, and some of the challenges facing policy makers, businesses, and individuals who all are motivated and interested in getting more people back to work.

It is a really interesting, and not terribly long but probably a weekend-type read, and I'd encourage anyone that wants additional macro-perspective on US labor markets to give it a read. The key takeaway, I think, is that even though high unemployment rates have persisted for some time, it is erroneous to think of unemployment and the unemployed as a static state. The data in the report illustrate the incredible energy and transition in the labor market - even in times of rising total unemployment many millions of people find jobs, and millions of others lose jobs, and still others exit the labor force entirely.

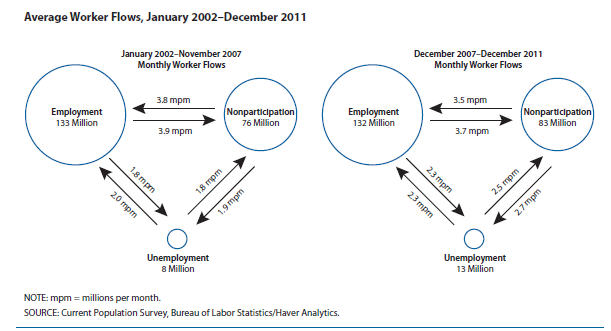

This chart from the report helps illustrate these labor market flows:

The charts show from Nov. 2007 until the end of 2011 that even while total Unemployment rose from 8M to 13M, and Nonparticipation also climbed by about 7 million, that in the last 4 years on average over 5M people per month actually found employment. In fact even in the depths of the recession, an average of 5.6M workers per month got jobs.

The report further examines the influence of highest level of worker education attained and the duration of unemployment and their impacts on the ability for workers to find jobs. As you'd expect two conclusions are apparent - one; the more education you have, the more likely you can find and keep employment, and two; the average time spent in unemployment is increasing, and feeding into a cycle that for many millions of people, is making a return to employment more difficult, as skills erode and optimism withers.

All told, while we mainly read and talk about unemployment, (especially in the popular media), in the context of one number - the rate of unemployment, the underlying market dynamics, the labor market flows, the 'search friction' between workers and openings, attitudes about risk from corporations, as well as national economic and political policy decisions all combine and conspire to make it difficult, in the opinions of the authors of the St. Louis Fed paper, to arrive at simple solutions to these problems.

But I do think while simple answers simply don't exist for this problem, a good first step is understanding more about the data, the history, and how decisions about policy impact these markets. And the only way to get started is to do the homework.

So this week, if you are at all interested in these issues, your assignment is to read Many Moving Parts: The Latest Look Inside the U.S. Labor Market, and let us know what you think.

Steve

Steve