What kind of a company are we? Take a look at the expense budget

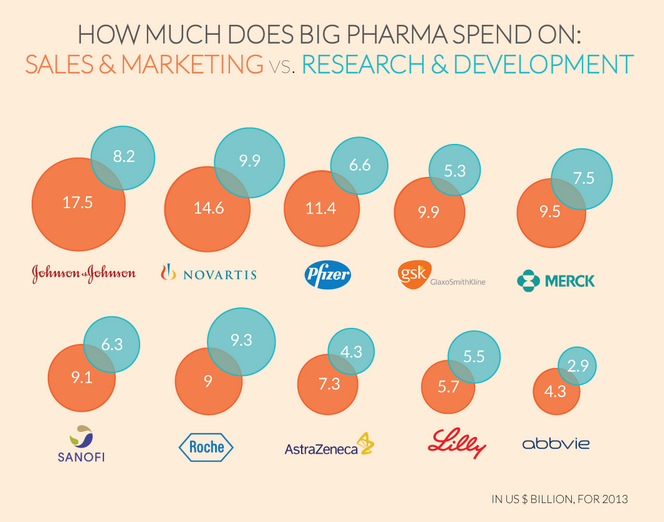

Take a look at the graphic below which shows how some of the world's largest pharmaceutical companies allocate funds to marketing and to Research and Development (spotted on the Big Picture blog):

As you can see from the chart, 9 out of 10 of these massive pharma giants spent more in 2013 on marketing efforts than on R&D. Disclaimer - I am by no means an expert in big pharma, so I can't and won't declare this seemingly reversed set of spending priorities as somehow 'wrong' or even unusual. But it is, to an outside observer at least a little surprising. We think, or at least I think, of these kinds of companies dedicating immense budgets to finding, developing, testing, and gaining regulatory approval of their products, not as massive marketing operations.

Step back from the pharma industry for a second to think about what this kind of data suggests more broadly. How these companies, and any company, decides to allocate their expense budgets says heaps about what kind of a company they are, or are intending to become, (or are being forced to become).

Moving funds over to marketing and sales and away from activities like R&D or customer support isn't necessarily a bad or less noble thing, but it is something.

The natural evolution of growing and maturing companies often dictates this kind of transition in spend and priorities. But when this shift happens and then takes hold over time, it eventually defines the company to some extent. One could argue that some of these big pharma companies are really marketing and sales organizations that do some product development to just keep the pipeline running.

Company culture is one of those HR blogging evergreen topics. It will be written about and discussed forever. But I can't recall the last time I saw a 'culture' piece talk about one of the most important 'tells' about what a culture really is and what is values. And that is how the 'culture' decides to spend its money.

As an HR/Talent pro it is probably worth a periodic check - how is your company allocating its funds, how are these allocations trending, how does that stack up with your peer companies?

The kind of company you are is as much defined by the expense budget as it is by anything else we do in HR.

Have a great week!

Steve

Steve