In a same-day delivery world, does waiting two weeks to get paid make sense?

I am a big fan of Amazon Prime and its subsidiary Zappos which take a very similar approach to package delivery. On either Amazon or Zappos, one or two clicks to find the item you want, one click to order, (at least for Amazon), and boom - a day or at the most two days later the goods are at the door.

But even next day delivery isn't going to be good enough for these eCommerce leaders, the game is moving towards same-day delivery, at least for the larger markets. Whether these same-day deliveries will be facilitated by the usual shipping companies like FedEx and UPS, managed via centralized drop-off/pick-up locations and lockers, or even executed by Jeff Bezos' armada of flying drones, one thing is for certain - consumers are going to receive (and demand) goods even faster than ever before.

And it is not just package delivery where consumers expectations for speed are increasing. Who wants to wait 7-10 business days for concert or sports tickets to be printed and mailed? We just have a code on our iPhones scanned at the turnstile. Don't want to walk tediously through the aisles of the grocery store? Fire up an app, make a few selections, (or just tap 'Send me my usual order') and an hour or so later you are swimming in Ritz crackers, Campbell's soup, and Mountain Dew. Heck, even the drive-through at the Starbucks is not enough of a time saver, soon the Starbucks app and some GPS location chicanery will have your order waiting for you the instant you pull in to the lot, (and it will be paid for too).

I could go on and on like this, but you know the point - technology is making it possible to deliver goods and services and experiences of every type faster and faster - to the point where many of them are almost now 'on-demand' and in almost real time. And that is what we, the consumer, wants and demands.

While these trends are influencing all manner of enterprise and business technologies, call them consumerization of IT if you like, one area where the 'instant access' kind of paradigm has not really made any headway in HR tech is in the area of payroll - specifically in hourly payroll where most workers have to wait days if not weeks to actually get paid for the hours they have worked.

The main reason is the typical corporate payroll cycle for hourly workers - most often paid on a bi-weekly basis, one week or so after the two-week reporting period concludes. Hours logged on the first day of a cycle might not actually show up in a paycheck for something like 18 or 19 days. And that is kind of a drag for workers that might be living paycheck-to-paycheck to make ends meet. This kind of problem, workers having financial obligations that do not usually wait for the corporate payroll cycle to complete has led to the rise of the Payday loan indusry, where people can get loans/advances on their paychecks from third-parties, usually at ridiculously high interest rates. Workers do get early access to their pay, but at such a high cost that for many it just starts a cycle of debt and fees.

A new startup called ActiveHours is attempting to end the need for these kind nasty Payday lending practices with a platform modeled after a simple principle: Employees are entitled to the pay for the hours they have worked immediately after those hours are recorded. Here's how it works from a recent review in TechCrunch:

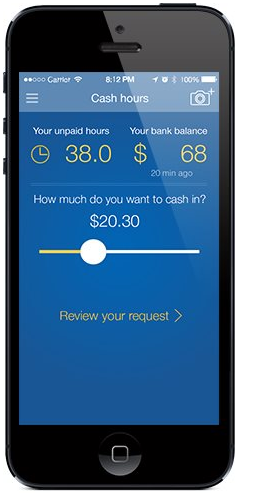

The Palo Alto, Calif.-based company has come up with a radical new way to charge for its mobile payment service that flips the lending model on its head. Activehours is selling a service that lets its customers get paid for the hours they work, without charging any interest on the payments that its clients receive. Users simply take a picture of their time sheet and specify how much money they would like to get paid from their earnings up to that point in the pay cycle.

The service means hourly workers can get paid as they go, enabling them to spend their wages however and whenever they see fit. Activehours only receives a service charge which is determined by the user themselves. The company has no set fees, nor does it charge interest on the money it disburses to customers.

Pretty simple, and kind of radical too. Employees take a picture of their time sheet, get verified by ActiveHours, then get essentially a free draw on their bi-weekly net pay at any time during the pay cycle, without have to pay the exorbitant kinds of fees and rates that the Payday lenders have typically demanded.

ActiveHours only gets paid through user-decided service charges, (a model while extremely worker-friendy, is certainly not sustainable, but still), and the employees can get at their earnings as they work, not only after some corporate-payroll calendar tells them they can.

Here is the money quote from ActiveHours founder Ram Palaniappan:

“Every year, more than $1 trillion of hourly pay is held back for two weeks because of the way pay cycles work today. Yet, more than half of hourly workers in the U.S. live paycheck-to-paycheck or borrow money to stay afloat,” said Ram Palaniappan, Activehours founder in a statement. “It doesn’t make sense to incur overdraft fees or take out payday loans when your workplace owes you money. If you work everyday, why can’t you get your pay every day?”

Kind of a good question, and one that ActiveHours is setting about trying to answer.

Note: I have never talked with anyone at ActiveHours and this is not a sponsored post in any way, I just think it is a cool idea.

Steve

Steve