The Geometry of the Deal

So do you want to know what I did this past Saturday night?

Scratch that, I assure you that you do not, as you would likely become distracted having to navigate the simultaneous emotions of boredom, pity, and incredulity.

So let's pretend for both of our sakes that I didn't spend a good portion of Saturday night re-watching (thank you Amazon Prime), the 1996 HBO movie The Late Shift, a 'based on real events' telling of the late-night TV wars of the 1990s following the retirement of TV legend Johnny Carson, long time host of NBC's The Tonight Show.

(Ok, just between us, this is what I did on Saturday night, don't judge, and roll with me on this)

Quick recap of the movie's key elements:

1. Johnny announces his plans to retire from TV in May of 1992, giving NBC effectively a full years notice and time to select his successor

2. NBC has to decide who will be the next host of The Tonight Show, an extremely important decisions because (at least in 1992), The Tonight Show was still very popular, and extremely profitable. This was a big deal for NBC, (and their corporate owner at the time, GE).

3. There are only two candidates. One, Jay Leno, who was well-liked, funny, (he was), and had become Johnny's regular guest host in the last few years of Johnny's run. And two, David Letterman, who had been hosting the Late Night Show on NBC, (the 12:30AM show that ran right after Johnny) for the past 10 years, and who was also popular, if slightly more edgy and hip than Leno.

4. The rest of the movie, (I won't spoil it for you, as if I need to worry about dropping a spoiler for a 20 year-old movie), runs through what happens in the run-up to NBC's eventual decision, and the chaos and corporate drama which almost immediately ensues.

I decided to watch this movie again for one specific reason, and that was not because I could not remember who did get The Tonight Show.

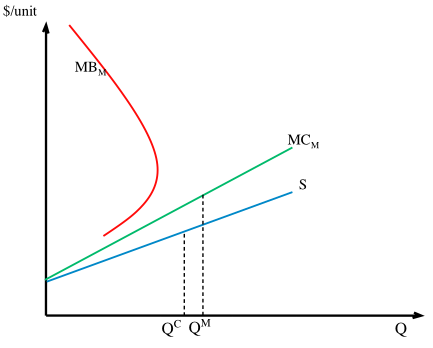

No, it was because I recently was in a discussion with a friend regarding a real-life contract negotiation, and during that discussion I wanted to advise my friend to essentially 'think bigger', to not necessarily get bogged down in trying to 'win' on the small items, but rather to try and garner support for something more expansive, something more wide and far-reaching, frankly for a pretty significant re-interpretation and definition of the business relationship altogether.

And then the phrase I was wrestling with trying to articulate finally popped into my head - I wanted him to change 'the geometry of the deal'.

And then, I remembered where I first, (and I am pretty sure the only) time I heard that phrase - the movie The Late Shift.

About a third of the way through the movie, Letterman comes to realize that NBC intends on awarding The Tonight Show host job to Leno, and is frustrated and confused and doesn't really know how to move forward. His ally (and Carson's producer), Peter Lassaly advises Dave to meet with a Hollywood agent, something Dave has in the past had no interest in doing. Lassally does convince Dave to meet with one of the most powerful agents in Hollywood, Mike Ovitz, and the 'geometry' line comes from Ovitz, when he sits down to meet with Letterman and Lassally.

(Note: I can't find a clip of just the Ovitz meeting, below is a YouTube embed of the full movie, fast forward to 35:12 for the meeting, which is only a little over 2 minutes long). Email and RSS subscribers, click through.

Here's the text of the Ovitz speech as well, in case you can't be bothered to mess around with the clip:

Michael Ovitz: Peter, I know Dave's circumstances, and so I know why you're here. Dave is a star of such compelling stature that frankly it makes me personally angry he finds himself this abused. We pride ourselves here at CAA in developing a career plan for our clients that protects them as much as it enriches them. David has set such an incredibly high professional standard and yet he is going disturbingly unrewarded. That just doesn't make any sense; it's simply bad business practice. Obviously, we have an interest in establishing a business relationship with you Dave, and you Peter. Frankly, we have worked out a career plan for David, and it includes securing everything for Dave that he wants. EVERYTHING. Of course that means an 11:30 television show. Dave will be offered an 11:30 show, and he will be offered it by every network. The geometry of the deal will be far larger, the studios will be in, the syndicators, the full range of the entertainment industry. We shall frame a deal that will make you one of the giants. And if you give us the privilege of working with you, CAA will take care of everything your talents deserve, and his spirit desires.

Awesome, right?

And if you did watch the clip in the movie when Ovitz makes the speech you will catch his confidence, his preparedness, ("Peter, I know Dave's circumstances"), and his all-around dominance of the proceedings. Dave leaves the meeting much more confident himself, which is how all the best coaches, agents, teachers, leaders, or bosses make the people they work with feel.

But most of all, and why this is so cool is that phrase - 'The Geometry of the Deal'. It's been in my head for 20 years, and now, hopefully, it's in your head too.

Go kick some a$$ this week.

I will try to as well.

Steve

Steve