CHART OF THE DAY: The American Dream of Renting

Ok, so perhaps that title was not totally fair, as the while the below chart could be interpreted in a couple of different ways, depending on your point of view and level of relative optimism/pessimism/cynicism.

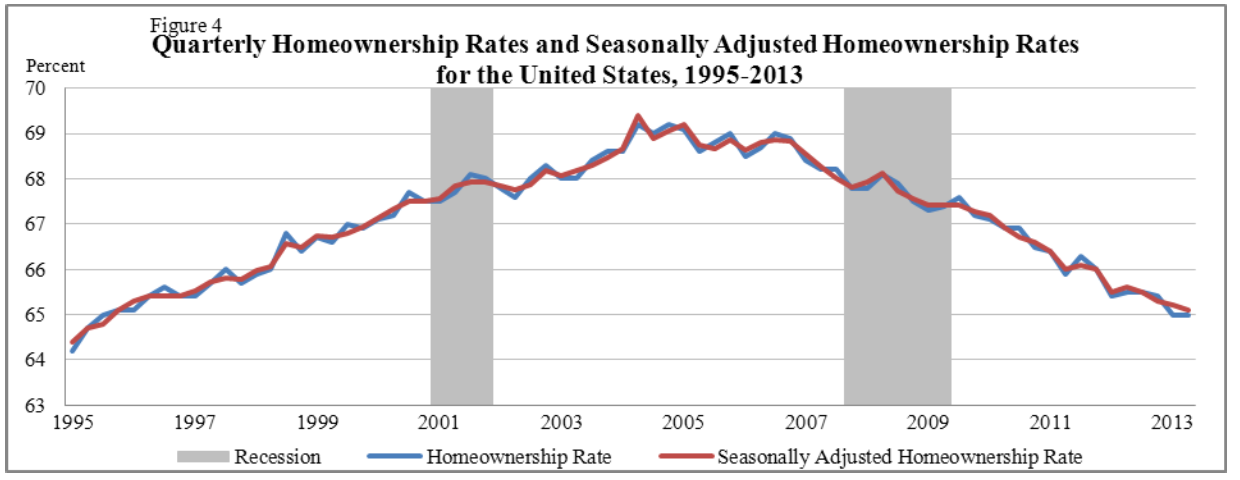

But first, the chart in question, showing the trends in American home ownership for roughly the last two decades, (my comments of course, after the jump):

The current percentage of Americans owning their homes stands at about 65%, roughly equal to the rate in 1995, prior to the last two recorded recessions, (as indicated by the gray areas on the chart).

And the rate has been declining since about 2004, well before the American financial crisis of 2008/9, the ensuing economic slowdown, and the dramatic tightening of the availability of mortgage credit. Combine tighter credit standards with the sharp rise in unemployment (and employment security) in the period of 2008 - 2010, then you have the basic root causes for the fall in home ownership. Even the historically low mortgage interest rates of about 2011 until, well, until now, have not been able to reverse this trend. Oh, and one more data point to consider - all cash sales of property (primarily from banks and other investors), have continued to rise - some estimates say these cash sales now constitute half of all transactions. Even if a prospective individual home buyer has a stable job, and can qualify for a home mortgage, they often find themselves losing out to a competing all cash offer from an investor or syndicate.

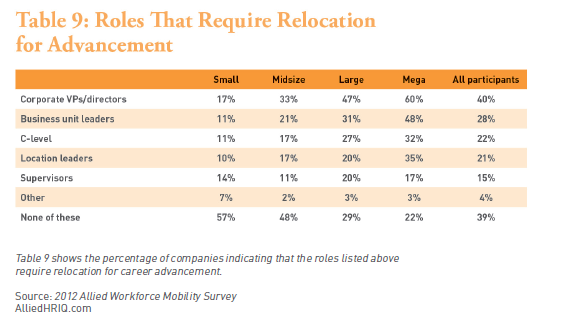

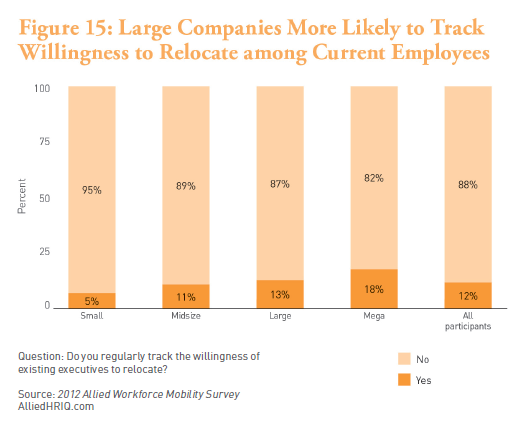

In the depths of the recession it was often theorized that employment mobility was becoming compromised by people's inability to sell (at a price that would be acceptable if they could sell at all), their existing homes in order to facilitate a job change or even a transfer inside their current company. In many parts of the country large numbers of homeowners were underwater on their homes, owing more to the mortgage holder than the home could expect to fetch in a sale.

In 2013 and perhaps in the future, the trends in the rate of home ownership and in the increase of all cash and investor-driven residential home sales, while seemingly not positive developments for the average employee, could be ones that end up benefiting the organization. In 2009 and 2010, organizations were probably finding it hard, (or very expensive), to facilitate employee transfers around the country or to convince that desirable candidate to relocate from one state to another when selling a home at a loss simply was too much of a financial burden to take on, no matter how fantastic the job opportunity might have been.

But with the home ownership trends heading downward, and the investor-driven all cash sales on the rise, the chances are increasing that the great candidate or that high-potential manager you'd like to send on a rotational assignment to Kentucky are going to much more able to make these kinds of moves in the future. Without the need to sell the house, well, most folks are just a few months away or a broken lease from taking the next great gig.

Of course, while not being burdened by home ownership makes someone more likely to listen to your opportunity or offer, it also makes them equally able and receptive to everyone else's offers as well.

Happy Halloween my friends.

Steve

Steve