Last week on the blog we noted the shift in the mix of annual employee compensation increases - companies have and are continuing to increase their use of one-time and variable comp increases like annual bonuses and lessen their use of base (and in theory, recurring), salary and wage increases. The argument, many companies make, is that variable comp awards tie comp more closely to individual and organizational performance measures and provide the organization more flexibility and adaptability to respond to changing market conditions and business performance.

We have even seen this trend play out in the wake of two recent legislative decisions that have combined to create a pretty significant windfall of excess cash/after tax profit for many of the US's largest companies. One, the reduction in the 'stated' corporate income tax rate from 35% to 21%. And two, the reduction of the tax rate on the repatriation of US company cash that has been parked in overseas accounts, and now can be brought back to the US at a lower tax rate (about 15%).

With all this additional cash available to many large companies (most of whom are large employers), it makes sense from an HR / Talent point of view to ask a pretty simple question: Will and to what extent will all this cash flow to employees in the form of salary/wage increases or bonuses?'

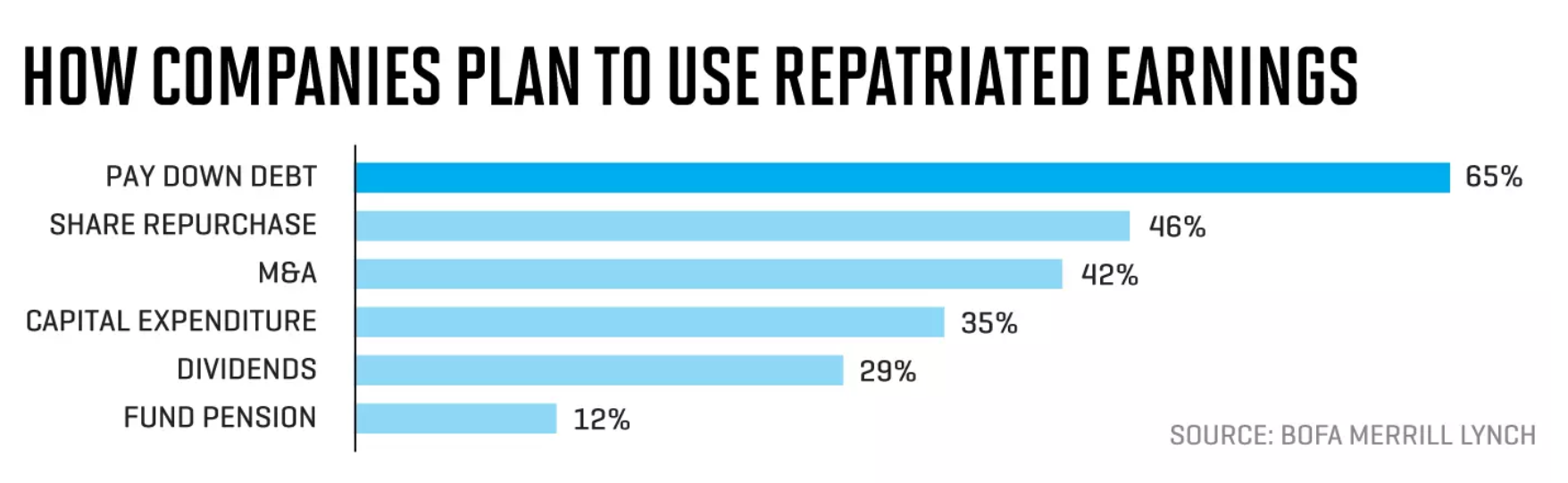

Well, sadly for most employees, and for HR and Talent leaders who might be advocating for increased investment in people, the short answer to the question is 'Hardly'. Take a look at the chart below, from a Fortune piece citing some recent BofA Merrill Lynch research on just what these companies plan to do with their soon to be repatriated earnings:

Looking though that list of top six likely uses of this repatriated cash, maybe you could argue that the one that came in sixth, 'fund pension' has some direct benefit to current employees. Share repurchases, which we will see again in a second when looking at the knock-on effect of lower income tax rates, could also benefit employees who participate in ESOP plans or have a decent bit of their 401(k) tied up in company stock. But that is an indirect, and incomplete benefit at best.

Another review, this time by the financial firm Goldman Sachs, paints a similar picture of who the likely beneficiaries will be from lower corporate tax rates. From a piece reported by Marketwatch:

Buyback announcements are up 22% this year to $67 billion in just six weeks, Goldman Sachs said in a note to clients. This follows a report by benefits consulting firm Aon Hewitt finding that 83% of large companies don’t expect the tax cut to boost salaries at all — just help pay for small bonuses companies like WalMart and AT&T, gave workers, which reporters soon discovered were, themselves, skewed toward higher-paid, longer-tenured employees in many cases.

And it comes as Goldman finds companies have raised guidance on re-investment in their businesses — the putative reason for cutting corporate taxes at all — only 3%.

A couple of things to note here. CEOs and Boards do have a responsibility to their shareholders - some would certainly argue that the shareholders' concerns matter more to corporations than any other stakeholders. So moves to increase the share price (repurchases), and return profits to the holders, (increased dividends), are definitely proper and prudent uses of excess cash/profits.

But the really small levels of internal re-investment, and commitment to improving the long-term compensation levels for employees is a little bit disconcerting. But it also reminds us of something really important. Namely, that for most large organizations labor cost, (and by extension, their investment in people), is just that - a cost that has to be managed.

What the organization is willing to invest, and whether they are willing to increase this investment is subject to a complex set of variables - competition for talent, product/service strategy, overall labor market conditions, the impact of automation and outsourcing, and even the legal/regulatory climate.

But what does not, yet, seem to be moving the needle on investment in people and employee compensation,(aside from the slew of copycat one-time $1,000 bonuses we heard all about), is this sudden windfall of excess corporate cash/profits as a result of recent corporate tax changes.

More simply put, organizations increase what they are willing to pay for any resource only when they have to, not because they are able to.

Apple won't volunteer to pay more per piece to their supplier of iPhone screens just because they can.

And they won't volunteer to pay their engineers, accountants, and facilities staff more just because they can as well. Interesting times for sure.

Have a great day!

Steve

Steve