CHART OF THE DAY: On the future of employer based health care benefits

Is it Spring Break where you live?

It is where I live - so I am going to be trying to balance some Spring Breaky things along with the blog, work, the HR Happy Hour Show and some other things.

So if you are trying to reach me on something this week please be patient more patient than normal.

But on to today's topic and Chart of the Day - and with a special bonus chart.

A few weeks ago on the HR Happy Hour Show I was joined by benefits expert Shan Fowler to talk about the Employer Health Care Benefits Update for 2018.On the show, we discussed changes (or potential changes) to the Affordable Care Act, how some employers may shift the health care burden back to employees, and what the future of employer-based health care benefits might look like. In that same vein, I wanted to present two charts today - one directly related to this topic of the future of employer health care benefits, and a second chart that may help to give some depth and context towards understanding the first chart.

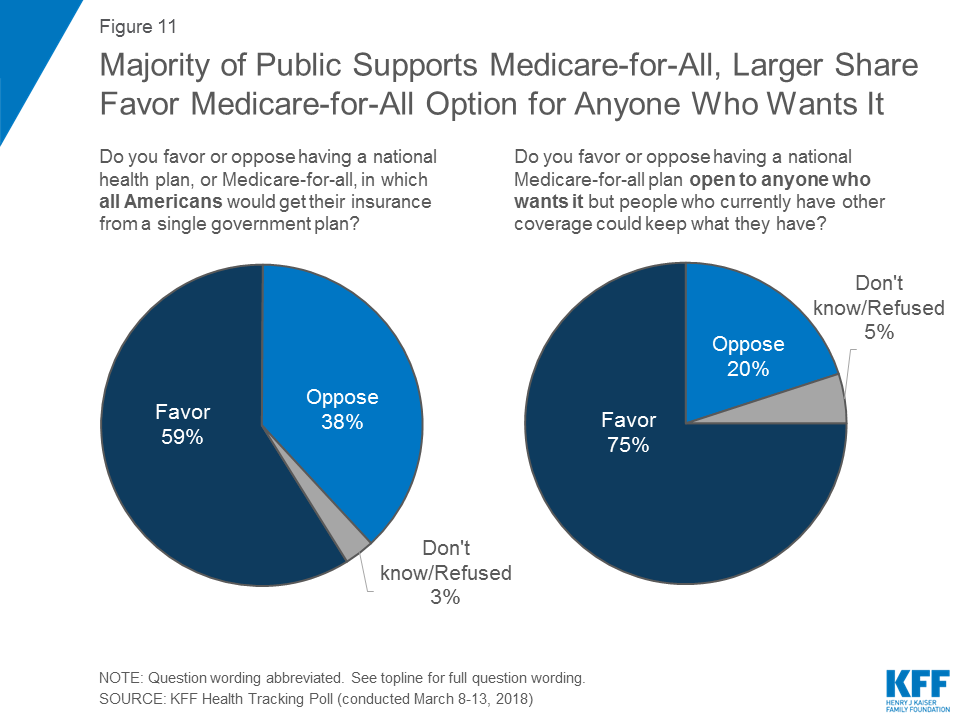

Chart 1 - Courtesy of the Kaiser Famlly Foundatain's March Health Tracking Poll, which asked a representative sample of over 1,200 US adults whether or not they were in favor of a 'national health plan, or a Medicare for all plan', and also if they favored such a plan that was 'opt-in' only?

Here are the results which showed 59% of Americans in favor of a national health plan, and 75% in favor of such a plan with an 'opt-in' provision.

Let's go to Chart 2 before offering up some comments and observations about what the data might mean.

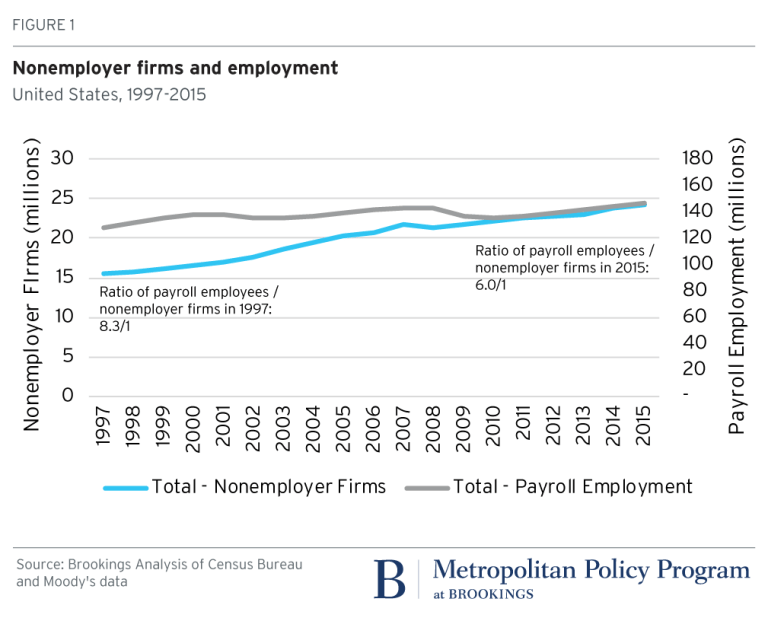

Chart 2- From the Brookings Institute, 'Rethinking worker benefits for an economy in flux', a look at the growth (and comparative growth) of non-employer firms, basically independent workers in the 'gig' economy.

For nearly two decades, the growth of nonemployer firms - firms that have no employees and mostly constitute incorporated self-employed freelancers (workers in the “gig economy”), has consistently outpaced traditional payroll growth. More and more workers in the 'gig' economy generally translates to more and more workers who lack access to 'tradtional' employment benefits - health care, paid time off, retirement and 401(k) plans, etc.

For nearly two decades, the growth of nonemployer firms - firms that have no employees and mostly constitute incorporated self-employed freelancers (workers in the “gig economy”), has consistently outpaced traditional payroll growth. More and more workers in the 'gig' economy generally translates to more and more workers who lack access to 'tradtional' employment benefits - health care, paid time off, retirement and 401(k) plans, etc.

And it's this trend in workplaces, and truly, in the nature of work and jobs themselves, that probably is driving the increases in interest and/or support for some kind of nationalized, and more importantly portable, set of health care benefits. Increased workplace fluidity, less growth in traditional payroll employment compared to gig work, and additional pressures on workers to provide child and elder care are all conspiring to make the idea of national/portable health care coverage more appealing to Americans.

Politics (and passions) on both sides of the spectrum will likely make the passage of any kind of nationalized or Medicare for all plan really unlikely in the near term. But that is not the only mechanism to create platforms for more portable health care - programs that would be more easily accessible to the growing number of workers who lack access to traditional employer-based plans.

A number of states, (most notably Washington) are proposing programs that would create non-profit benefit providers, to which employers of 1099 workers would contribute, and who would then collaborate with workers to determine which kinds of benefits to offer - like heath care, retirement, and PTO. Other state and local laws that have expanded access to retirement plans and paid time off and family leave are all being pressured to expand access to independent worker as well.

The growth of the gig economy has changed and will continue to change the way we think about work, workplaces, jobs, and careers. It just might also change the way we think about and ensure access to, affordable health care in our country too.

Have a great week!

Steve

Steve