CHART OF THE DAY: Hoping it doesn't rain

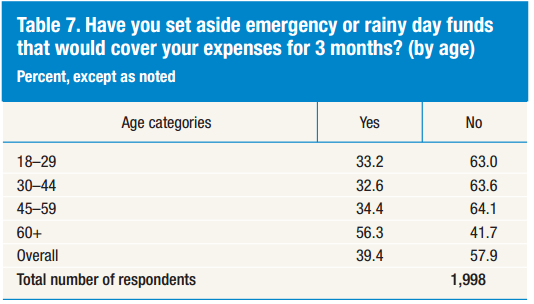

Today's Chart Of The Day comes courtesy of the Federal Reserve Board's recent and definitely interesting Report on the Economic Well-Being of U.S. Households in 2013.

The report, an in-depth look at the state of the American consumer/citizen in 2013 across a wide range of topics (debt, savings, job readiness, confidence in the economy, etc.), has a plethora of great insights and data sets about the economy and I probably could have picked about 15 different charts/tables to call out here.

But the one I was most interested in is below, having to do with American's readiness or ability to withstand economic hardship like a job loss or a major (and costly) health crisis. Turns out, many of us are not at all prepared for those situations. Here is the data, then some comments as per usual from me:

Wow, well over half of the survey respondents, (survey group and methodology here), report that they have not saved or set aside a 3-month emergency fund as a hedge against a sudden or unexpected loss of income. That is pretty bad, and even worse still when you think that many financial planner/advisor types will push their clients to have a 6-month rainy day fund at all times.

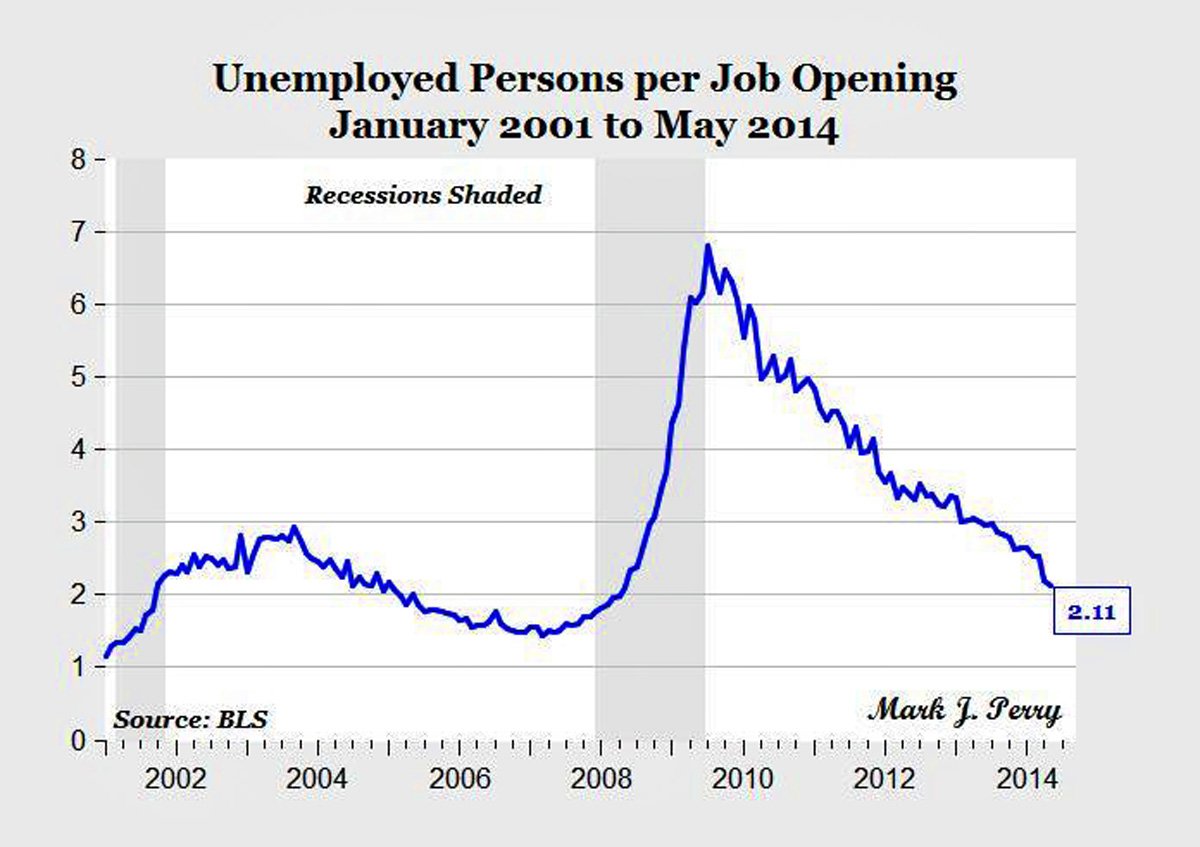

While many of the macro-economic indicators have begun to show an improving economy, (unemployment rate, ratio of unemployed to job openings, even most of the major stock market indices), this kind of a statistic on the relative lack of preparedness for unexpected financial distress reminds us that the effects of the recession are much longer lasting than we perhaps like to think.

If your employees are at all closely aligned with these results, then that means that perhaps half of them are much closer to personal financial crisis than they should be. And that is kind of a drag, and kind of a heavy burden to be carrying around. It also can make people 'play it safe' a little too much, over-compensating against any perceived risk in their decision making, as they get consumed with fear of losing their income if they were to get sacked for making the 'wrong' decision.

I think people probably perform better when they are excited at their jobs, not when they are afraid to lose them.

Have a great week!

Steve

Steve