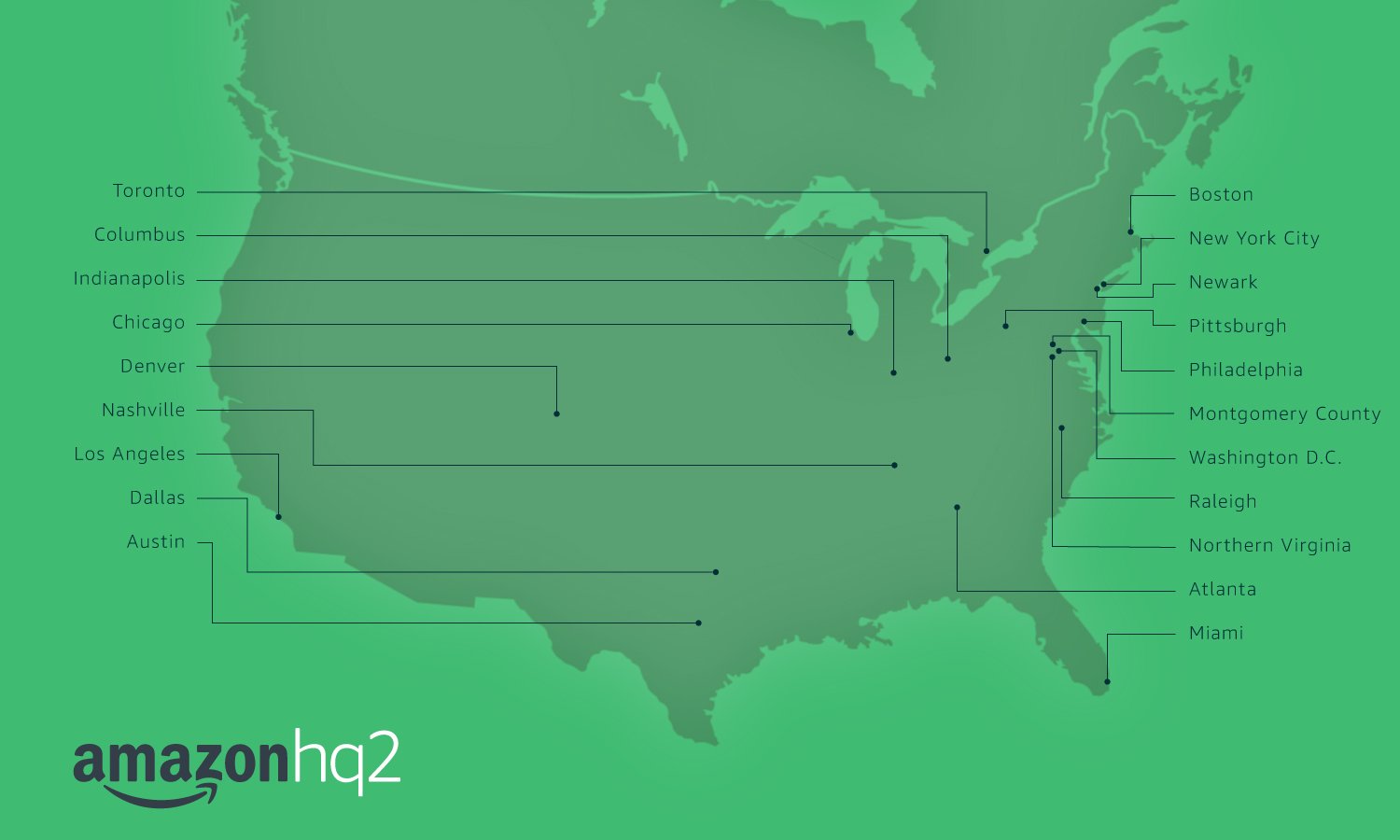

UPDATE: Amazon just told you the top 20 cities for business investment in North America

Surely you heard about Amazon's announcement of their intentions to build a second company headquarters, the so-called HQ2, in the coming years, and the widely covered RFP process to help them identify candidates (cities and regions), for this new HQ2. I wrote about the process last October here.

Over 238 cities submitted bids to become the home of HQ2, and this week, Amazon named a short list of 20 cities that have made it to the second round of consideration, where Amazon will work more closely with these cities to dive deeper into the proposals, to get additional information, and to winnow down the list to the eventual winner - the home of the new HQ2.

This is a big deal for these 20 contenders - $5B in investments and as many as 50,000 high-paying jobs.

Here's the list of cities that made the short list, as well as a map showing the 20 - more on that in a bit.

Kind of the 'usual suspects' list I suppose, but a couple of things stand out for me.

One, nothing in the NorCal/Silicon Valley area. Probably a couple of reasons for this. Amazon has always seemed to indicate that it wanted more of a geographical balance between its current Seattle HQ and the eventual HQ2, pointing to a midwest or eastern location as a more likely selection. And two, I wonder if Amazon just wants no part of the already overheated market for talent, real estate, and inflated cost of living that comes with the Valley.

Also, from the long list of 238, which certainly included a lot of places that had no real chance at meeting Amazon's requirements for population, talent availability, access to transportation hubs, etc., the final 20 does not include even one true 'outlier', a real longshot location that would have at least made things interesting, (if you are a betting person, anyway). Pretty much any of the 20 on the short list would seem reasonable should they eventually win the bid and become the home of HQ2.

Finally, in case you or your leadership were wondering just what were the best locations in North America to consider a similar, major investment, well, Amazon might have done the first wave of analysis and due diligence for you. You can almost look at the Top 20 list from Amazon as a starting point and work from there. And believe me, even the 19 cities that don't win this bid will remind you and everyone that they were a finalist for one of the largest US corporate investment initiatives ever.

And since everything is more fun when there is something on the line, I present Steve's opening odds for each of the 20 finalists to be named the home of the new HQ2.

Reminder: These odds are presented for entertainment purposes only, please, no wagering.

Have a great day!

work,

work,  workforce tagged

workforce tagged  amazon,

amazon,  investment,

investment,  labor,

labor,  workforce,

workforce,  workplace

workplace  Email Article

Email Article

Print Article

Print Article