REPRISE: Whose Labor Market is it Anyway?

Note: The blog is taking some well-deserved rest for the Holidays (that is code for I am pretty much out of decent ideas, and I doubt most folks are spending their holidays reading blogs anyway), and will be re-running some of best, or at least most interesting posts from 2014. Maybe you missed these the first time around or maybe you didn't really miss them, but either way they are presented for your consideration. Thanks to everyone who stopped by in 2014!

The below post first ran back in July as a part of the CHART OF THE DAY series and was a great example (in convenient chart form) on a subject I hit quite a few times in 2014 - the tightening labor market and its impacts and talent and work. Long story short: In 2014 the candidates strengthened their control of the market and HR/Talent pros can't ignore that fact any longer.

Happy 2015.

----------------------------------------------------------------------------------

Whose Labor Market is it Anyway?

There is a simple answer to that question, really.

The candidates run the current labor market, at least for large, (and growing) swath of managerial, professional, and technical roles.

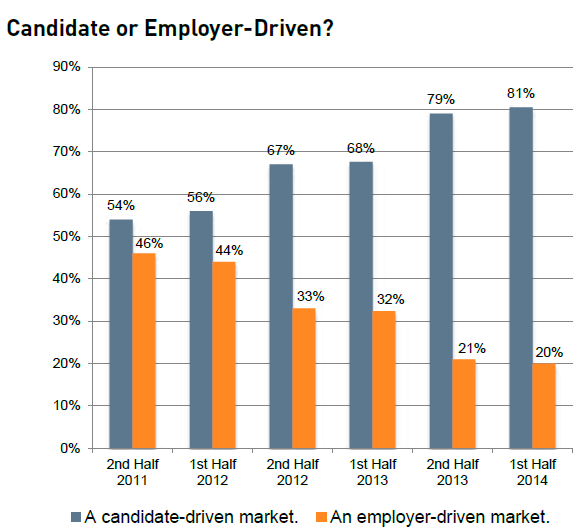

Check out this week's Chart of the Day, a look at how recruiters see the labor market - candidate driven or employer driven, courtesy of the MRI Network's latest recruiter sentiment study, (as always, some pithy commentary from me after the chart)

Wow - pretty simple and clear to see how at least this group of surveyed MRI Network recruiters have seen the labor market shift pretty dramatically in just two and a half years.

From late 2011, when the sentiment was that that the power and leverage in recruiting was about an even split between candidate and employer, to one where now these recruiters see about a 4x advantage for the candidates, this shift will have some pretty profound implications for many HR/talent pros.

Quite simply, offers to candidates with desirable, in-demand skill sets are going to have to get sweeter, and they are going to have to happen faster. Digging in to the MRI data you see that the primary reason candidates can't be closed is that they have accepted a different job offer. Sure, there are plenty of factors at play here, but the lesson is that just like in the market for desirable real estate in New York or San Francisco, the market for top candidates is likely to be super-competitive, with candidates holding signifcant leverage and multiple offers.

One more nugget from the data - candidates accepting counter-offers to remain with their current employer are rising. Whether or not it makes sense to even make counter-offers is definitely subject to debate, but the fact that if you don't at least consider the practice for your in-demand talent, you are likely going to find yourself having to replace at least some of that talent sooner than you might have liked.

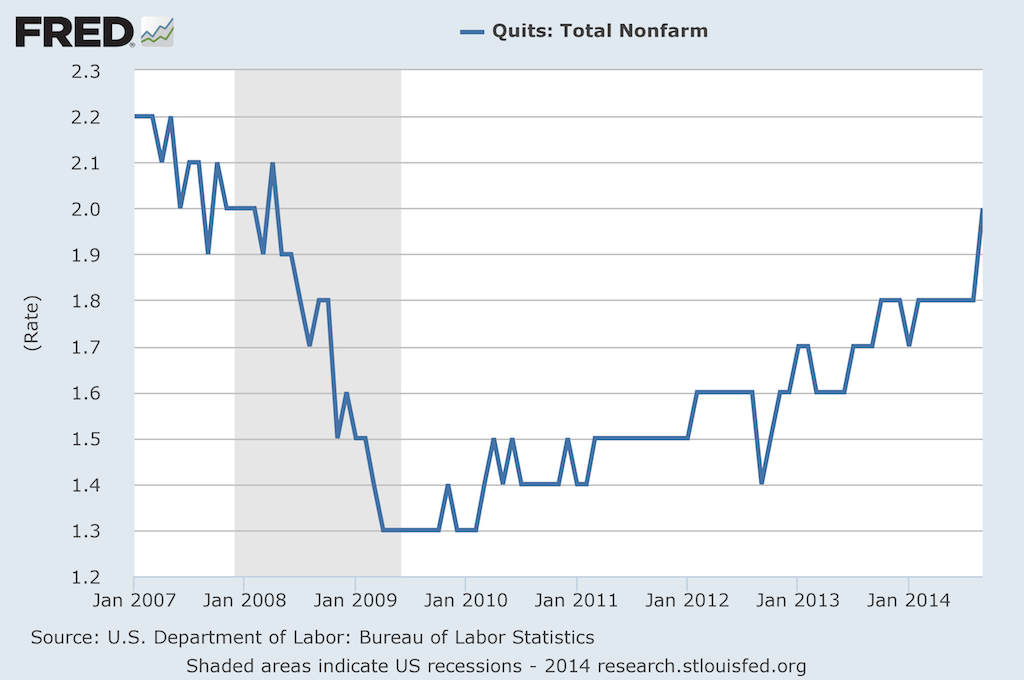

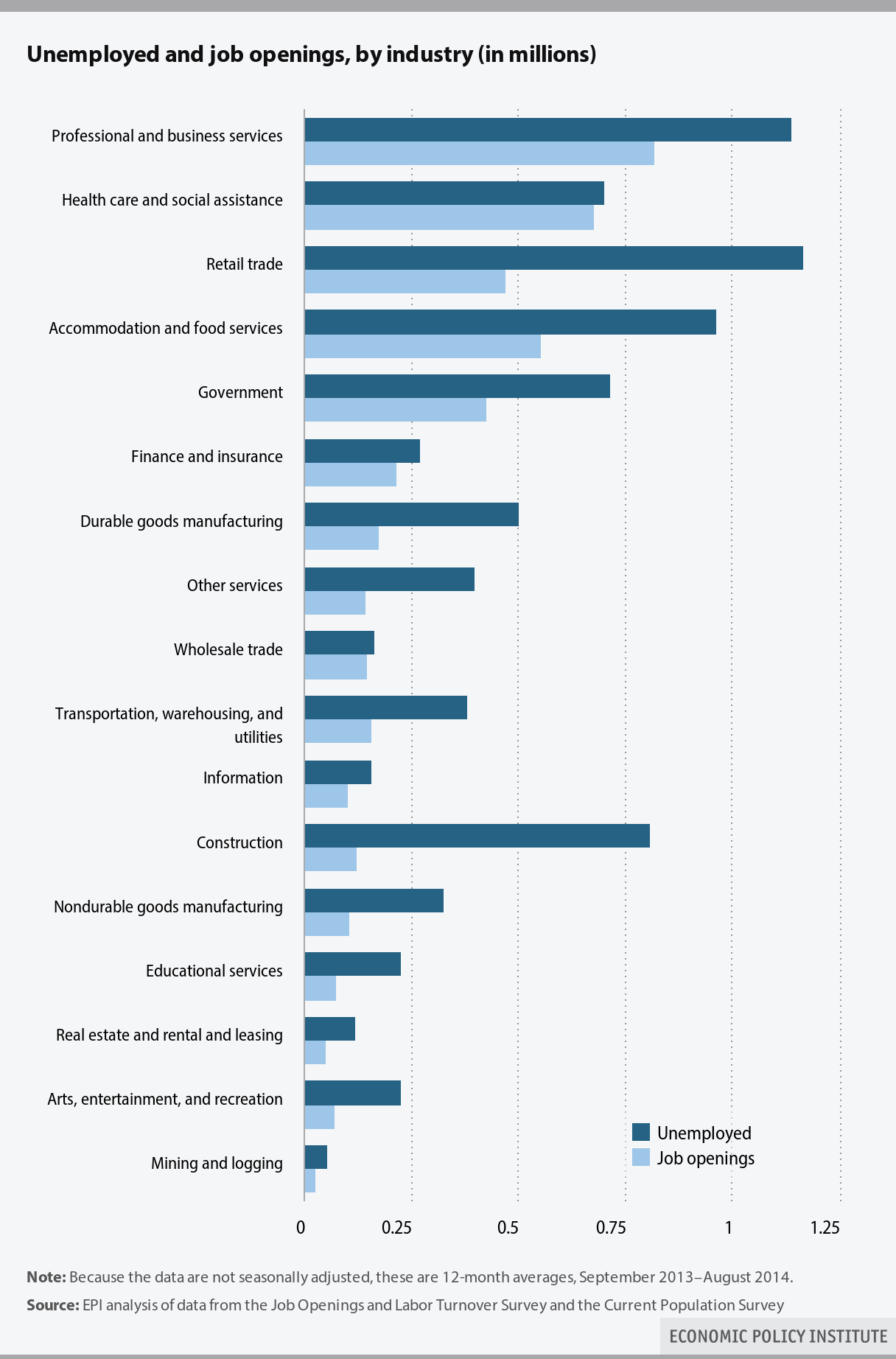

Looking back over this data, and the last few Charts of the Day I have posted and it continues to become more clear - job openings are up, employees are more willing to jump for a better opportunity, the competition for candidates is getting more fierce, and the strategy and tactics you were using as recently as 2011 probably are not going to work in labor markets where the best candidates have all the power.

Have fun and be careful out there.

Steve

Steve