CHART OF THE DAY: How large is the 'gig' economy?

In my 'What HR should and should not be talking about in 2016' piece from early January I had the 'gig' economy listed as one topics that we collectively needed to stop talking and thinking so much about this year. By way of refresher (mostly for me), here is what I said in January about the 'gig' economy:

"The 'Gig' Economy - Here's the thing about the rise in importance of the so-called 'Gig Economy', it is quite possible that its growth as a percentage of the labor force has been generally exaggerated possibly due to the oversized coverage that the largest Gig company, Uber, has received over the years. According to this Wall St. Journal piece from last July:

Far from turning into a nation of gig workers, Americans are becoming slightly less likely to be self-employed, and less prone to hold multiple jobs. Official government data shows around 95% of those who report having jobs are accounted for on the formal payroll of U.S. employers, little changed from a decade ago.

If Uber and its ilk were fundamentally undermining the relationship workers have with employers, that shift would be showing up in at least some of the key economic indicators. Hundreds of thousands of Americans, or even a few million, may have dabbled in the gig economy, but in the context of the 157 million-strong U.S. labor force, the trend remains marginal.

It is possible that since there are likely more 'Gig' workers in coastal 'elite' cities like New York and San Francisco, and folks in these cities dominate the conversations in the media, that it just feels like the Gig economy is fast becoming the dominant form of work. But the data just doesn't reflect that, at least not yet. And it likely will not in 2016 or in 2018 or maybe even in 2020. So for now, it makes sense to think about your labor force composition, sure, (just like it always has), but massive, fundamental changes in that mix of labor is not typically top of mind for most organizations."

So that was my take in January and two months later I have not really seen much if anything to make me think any differently about how important/influential the 'gig' economy really is to the vast majority of workers, organizations, and HR leaders. Today's CHART OF THE DAY courtesy of the JPMorgan Chase research folks seems to back that conclusion up.

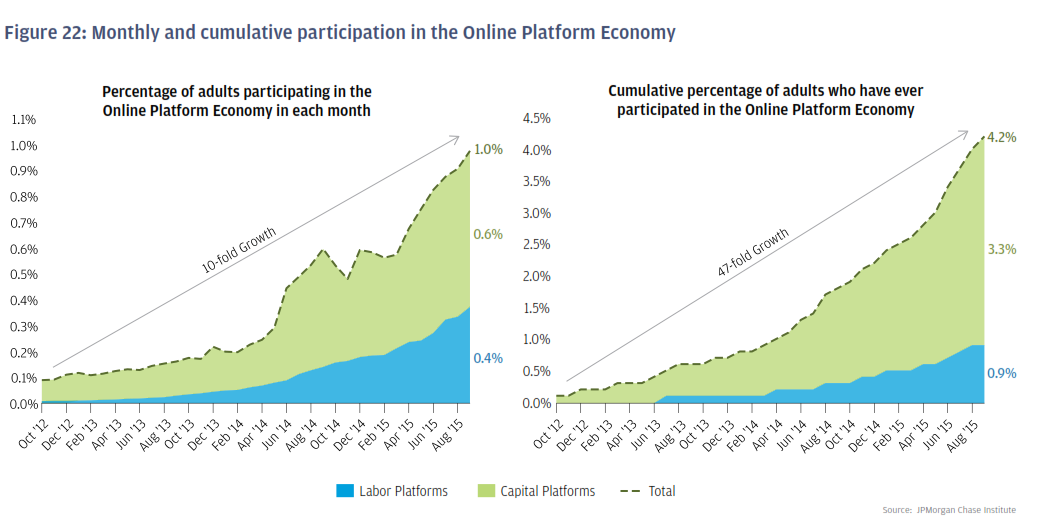

Taken from a three-year study of over 1 million JPMorgan Chase customers, the survey titled 'Paychecks, Paydays, and the Online Platform Economy' attempted (among other things) to get a better understanding over a three-year period just how important the 'gig' economy was/is in terms of worker participation levels and contribution to overall individual income. The entire report is interesting, but the chart I want to share is below, on the overall participation rates in 'gig' work. Here is the data, and the as you demand, some FREE comments from me:

Apologies if some of the figures on the charts are a little tough to read, so I will just repeat the headline numbers - in Sept. 2015 the final month of the study, about 1% of individuals earned income from the 'gig' economy. In the second chart we see that in the 3-years of data up to Sept 2015, that about 4% of individuals had at any time earned income from the 'gig' economy.

Apologies if some of the figures on the charts are a little tough to read, so I will just repeat the headline numbers - in Sept. 2015 the final month of the study, about 1% of individuals earned income from the 'gig' economy. In the second chart we see that in the 3-years of data up to Sept 2015, that about 4% of individuals had at any time earned income from the 'gig' economy.

So 1% of JPM's surveyed customers were active on Uber, AirBnb, EBay ,and the like in Sept 2015 and 4% of people overall at some time earned some income from working (or selling things), on one of these platforms.

While both figures represent significant growth in the reporting period, both were growing from incredibly small starting points. The truth is that the vast majority of people are not participating in these platforms and the ones that are, (another major section of the survey data), are using it as a supplement to more 'regular' forms of income, i.e. 'normal' jobs. Said differently, the chances are the only Uber drivers you have ever met are the ones that have driven you somewhere.

To get back to my original point from January, while we read lots and lots about the 'gig' economy, its actual impact and influence on most worker's lives is not all that significant, at least not yet. If you are at all interested in this kind of data, I encourage you to check out the full JPMorgan Chase study here.

Steve

Steve