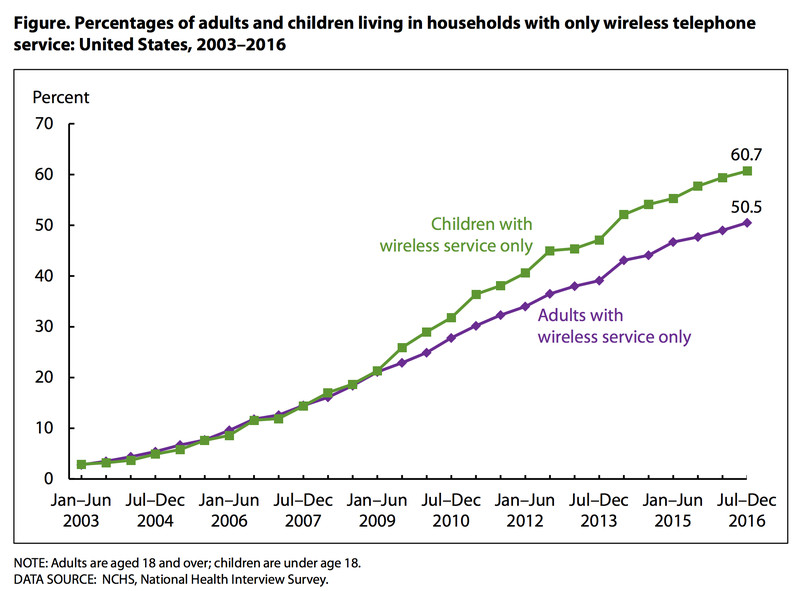

CHART OF THE DAY: The Decline of the Landline

Really interesting data from your pals at the National Center For Health Statistics on the long, slow but seemingly irreversible decline of the home landline phone. Turns out, if you have dropped your landline to go mobile only, you are not all that odd any longer.

Here's the data and as you constantly demand, some FREE comments from me after the chart.

Some really interesting data for sure. The key points or takeaways for me:

1. More folks than not have ditched the home landline. Just over 50% of households are now mobile only. Pretty soon it will be kind of odd and weird to still have a landline. Additionally, more than 70 percent of adults between 25 and 34 were wireless only.

2. Being wireless only, as a majority of households are now, means, (as if you didn't know this), that our mobile phones are constantly powered on, are always within reach, and have become probably the most indispensable piece of technology we own. What could you go without with longer, your mobile phone or your car? Or your TV? Or your coffee maker? I might choose the coffee maker, but the car and the TV I would give up. Why not? I can request an Uber with my phone and stream the NBA playoffs on my phone. Once my phone can make coffee, well...

3. Since the mobile phone is the most important piece of technology most of us use, then gaining 'share' of people's phpne time, no matter of you are in marketing, recruiting, sales, or even HR, is the most impactful thing you can do to advance your agenda. I would posit that at least half, if not more like 75%, of the efforts you are making to reach people should be focused on how you are reaching them on their mobiles. We all know this but when I see data about the usage and penetration rates of mobile technology for HR I am not so sure we are really applying what we know to be true.

Anyway, that's it for me. I'm out, have a great weekend!

Steve

Steve