CHART OF THE DAY: Big Trends in Working Age Population

Super quick hit for a summer let's-get-out-of-here-and-head-to-the-beach Friday where, at least here in the USA, many of us are going to tire of the phrase 'Corn Sweat' (go ahead and Google it).

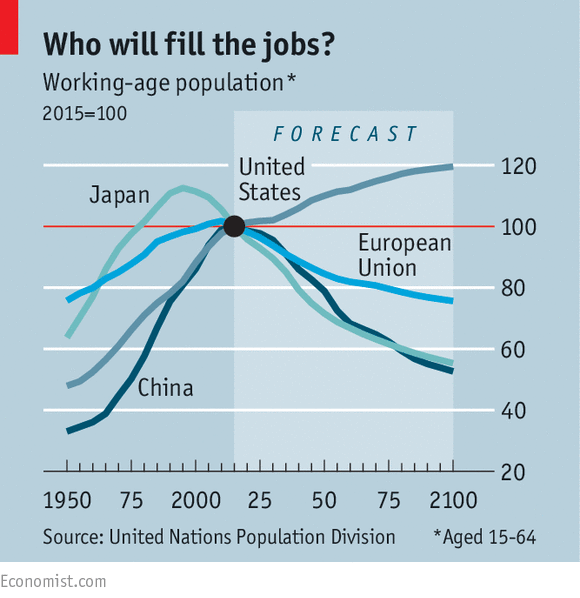

Today's chart comes from our pals at the Economist, from a piece titled 'Vanishing Workers'. First the data, then some quick observations from me before you can power down and crack out the sunscreen.

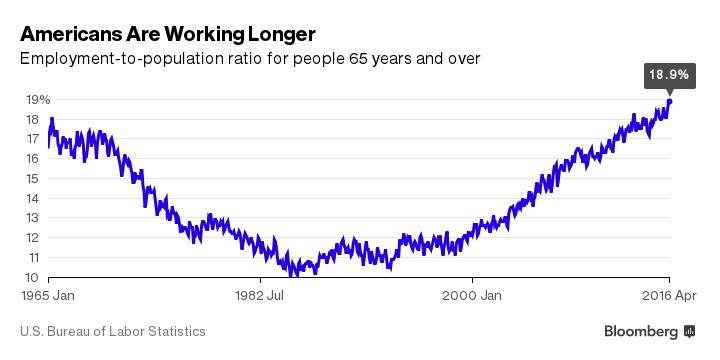

In a nutshell, this data suggest the working age populations, (15 - 64), in China, Japan, and Europe are all set to fall (relative to a 2015 baseline), somewhat dramatically in the next few decades, while by the same measure, this group will continue to rise in the US, (albeit at a slower rate than the recent past).

What happens (in general), when there are relatively fewer available workers, and what might be the implications in the USA where we will be bucking against this trend?

1. Fewer workers generally lead to rising wages, at least in the near term. And there is plenty of evidence of this already happening in China, where increased competition for workers (especially in manufacturing), has driven up wages for these workers, and made many firms think again and re-evaluate the cost advantages of locating these kind of operations in China.

2. Falling working age populations impact industries in different ways. With fewer workers, (and an increase in the dependency ratio, the total number of children and elderly divided by the working age population), housing and construction tends to suffer, as there is less demand for new, and larger housing from workers overall. But health care, child care, and related service industries might fare better, with an increased burden of care demanded by larger proportions of kids and older people.

3. For the US, one of the few industrialized economies that will not see such a fall in working age population over the coming years, the news is pretty positive. Larger proportions of working age folks tend to have a pretty direct and beneficial impact on GDP, output, and overall quality of life. And of course more folks in their prime earning years reduces the overall drag on the economy that can result from a higher dependency ration, all things being equal. There should be less need to raise payroll and corporate tax rates for example, in order to continue to fund things like Medicare and Social Security. The downside risk of course, is that jobs and opportunities for workers have to rise commensurately with this demographic trends, or else you end up with higher than desirable levels of unemployment or under-employment. But balanced against the alternative, potentially not having enough prime age workers to meet demand, (which will send investment elsewhere), it seems the US position to be the more desirable one in the long term. And for my line of work, the HR Tech space, it seems clear that growth and opportunity for HR Tech companies will continue to primarily reside in the USA, as Europe and other countries working age cohorts, (the 'users' of HR Tech), continue to fall.

Love the data. Love labor market demographics. If that makes me some kind of a geek, so be it.

Me fretting over me Level in Pokemon GO also makes me a geek, but for a different reason.

Steve

Steve