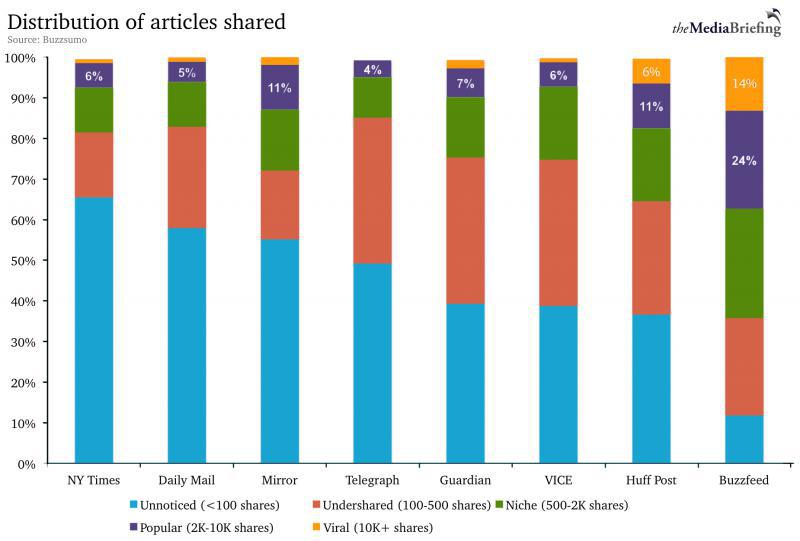

CHART OF THE DAY: What does it take for content to get noticed?

Really interesting piece, (with accompanying chart that I will re-share below), on the GigaOM site on how social and online sharing is now truly the way readers (and potential customer and job candidates) discover content.

The gist of the article was to point out that while they might like to think they are not in the same business as Buzzfeed, even more 'respected' publishers like the New York Times have to compete with the Buzzfeeds of the online world using modern metrics that describe success in online content creation - namely social shares (Twitter, LinkedIn, Facebook, etc.).

Check out the chart below, (Email and RSS subscribers may need to click through), then some FREE commentary from me after the data:

1. It is pretty obvious that for these big publishers, the bar for labeling a piece of content a 'social' success is really pretty high - at least 2K shares. Think about what you and your company might be sharing on social networks from your corporate blog or posting your open jobs on LinkedIn or Twitter. Two thousand shares of piece of content is a ton of shares, yet by the standards of the modern web, that barely starts to get you noticed. Less than 100 social shares leaves your content essentially 'unseen'.

2. Unless, of course, it is 'seen' by the exact, right people. And that means most of us (me too, just look at the number of RTs of this post for example), have to really understand how to determine, classify, target, and attempt to engage a specific target market of interest in order to have success. There is almost no way any of us 'normals' are ever going to approach mass social virality like the masters of the modern web (Buzzfeed, HuffPo) can. If you post a job on Twitter and it is not RT'ed does it even exist?

3. For the HR Tech spin on things, if you have employed a social sharing strategy for your jobs and employer brand building content, but you are not utilizing one of the several HR tech tools on the market that provide the capability to track, analyze, and help you determine actual results (clicks, shares, applicants, hires), for your jobs content, then you probably need to consider that investment in 2015. Since the easy and most common measure of success on the social web, absolute number of 'shares', is almost always going to leave you in the 'unnoticed' bucket, you need to find a way to 'prove' your social strategy is actually working. And the only way to do that is to better understand what happens to those lonely tweets after you send them out into the big, scary, social web.

Happy Tuesday. Hope this post breaks out of the 'unnoticed' category.

Steve

Steve