REVISITED: For American workers, the quits keep coming

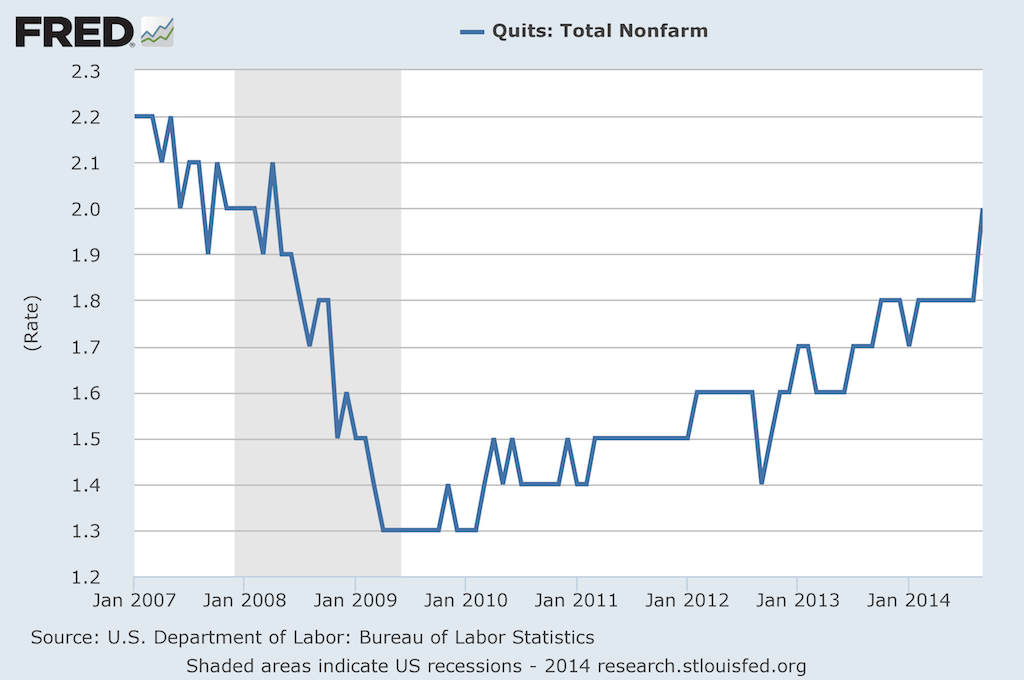

Back in February I posted CHART OF THE DAY: The Return of the Quit, a look at the increasing rate of 'quits', (HR nerds can call them 'voluntary separations' if that makes you feel better), across the American labor market.

Back in February, the news was that quits were rising from the financial recession low point of 2009-2010, reflecting growing individual confidence in the labor market and consequently placing pressure on organizations to develop retention, replacement, succession planning strategies.

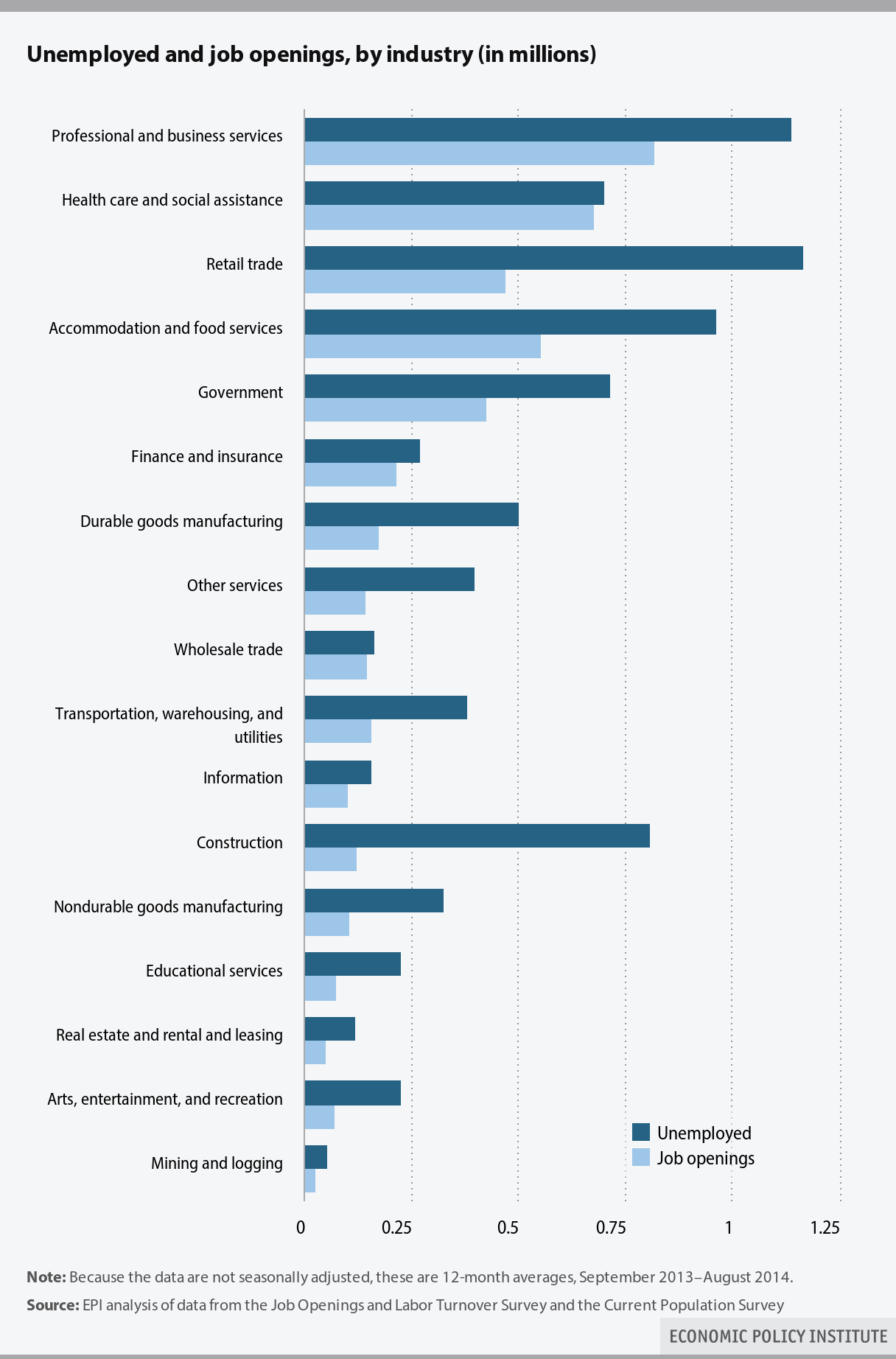

Fast forward about nine months to the latest data on quits, (Note: this data comes from the Bureau of Labor Statistics JOLTS (Job Openings and Labor Turnover Survey) report), and the story about quits continues to play out along the same lines as I talked about in February.

I'm going to hit you with the updated data below, then revisit my (FREE) commentary after the jump. I actually think all the points I made about th February data still apply in November, the question really being if we as organizational talent pros are paying enough attention to this data.

Here is the latest data, showing the Quit rate climbing to about 2%:

Some thoughts:

1. 'Quits' are a function of several factors, (personal circumstances, the magnitude of the jerkitude of your managers, people self-selecting out as not being in the right job, etc.), but most observers of the Quit rate on a macro level ascribe movements in the rate to worker's confidence in their ability to find another, and what they think will be a likely 'better', job. The rate moving up, to a level that is approaching the pre-recession level, is a signal that overall job market confidence is rising.

2. So while you and many other HR/Talent pros are lamenting about 'hard-to-fill' jobs, simultaneously more of the workforce are thinking of themselves as 'easy-to-place'. I'm not sure how that apparent paradox will work out, (probably very differently depending on location, skills, etc.), but it is kind of interesting and amusing at the same time.

3. How you are thinking about and reacting to news of a good employee quitting is probably changing too. In 2008 or 2009, you might have reacted by thinking, 'What is she crazy? Where is she going to find another job with as good pay/benefits/cupcake Friday like we have here?'. Now? Probably you'd think more along the lines of 'Hmm... She's going to XYZ Corp? I wonder if she could bring me over there too.'

4. Last, while the Quit rate increasing kind of feels like it is a good thing, there is certainly some warning signs as well. For one, those recent quitters might find that their skills and experience are not in as high a demand as they figured, and thus end up spiking the unemployment rate in the short term, (as well as having to take a boatload of grief from people questioning their sanity for quitting a perfectly good job). They might find, even today, that keeping a job is much easier than finding a job. And increasing worker confidence might put pressure on companies to increase wages, which can also have a detrimental effect on growth and profits.

So take a look at the JOLTS report if you are interested in this kind of data, I think it gives a little more color and depth to the more widely reported headline of the total rate of unemployment.

Are you seeing an increase in 'quits' in your shop?

Ready to quit yourself?

Have a great week!

Steve

Steve